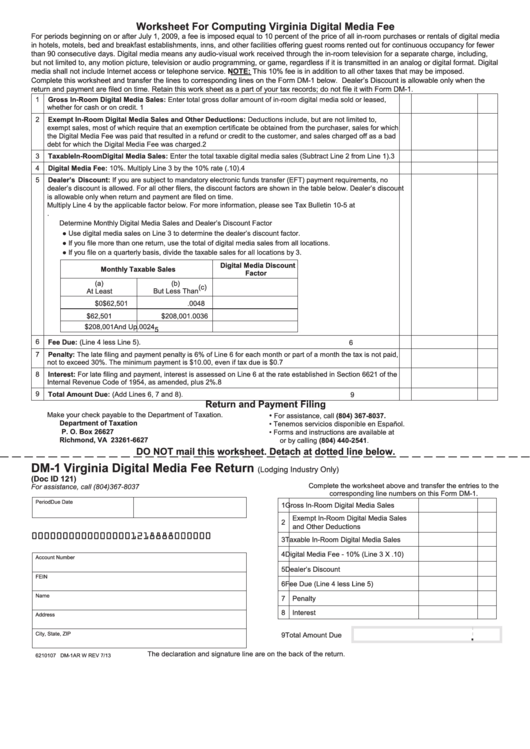

Worksheet For Computing Virginia Digital Media Fee

For periods beginning on or after July 1, 2009, a fee is imposed equal to 10 percent of the price of all in-room purchases or rentals of digital media

in hotels, motels, bed and breakfast establishments, inns, and other facilities offering guest rooms rented out for continuous occupancy for fewer

than 90 consecutive days. Digital media means any audio-visual work received through the in-room television for a separate charge, including,

but not limited to, any motion picture, television or audio programming, or game, regardless if it is transmitted in an analog or digital format. Digital

media shall not include Internet access or telephone service. NOTE: This 10% fee is in addition to all other taxes that may be imposed.

Complete this worksheet and transfer the lines to corresponding lines on the Form DM-1 below. Dealer’s Discount is allowable only when the

return and payment are filed on time. Retain this work sheet as a part of your tax records; do not file it with Form DM-1.

1

Gross In-Room Digital Media Sales: Enter total gross dollar amount of in-room digital media sold or leased,

whether for cash or on credit.

1

2

Exempt In-Room Digital Media Sales and Other Deductions: Deductions include, but are not limited to,

exempt sales, most of which require that an exemption certificate be obtained from the purchaser, sales for which

the Digital Media Fee was paid that resulted in a refund or credit to the customer, and sales charged off as a bad

debt for which the Digital Media Fee was charged.

2

3

Taxable In-Room Digital Media Sales: Enter the total taxable digital media sales (Subtract Line 2 from Line 1).

3

4

Digital Media Fee: 10%. Multiply Line 3 by the 10% rate (.10).

4

5

Dealer’s Discount: If you are subject to mandatory electronic funds transfer (EFT) payment requirements, no

dealer’s discount is allowed. For all other filers, the discount factors are shown in the table below. Dealer’s discount

is allowable only when return and payment are filed on time.

Multiply Line 4 by the applicable factor below. For more information, please see Tax Bulletin 10-5 at www.

policylibrary.tax.virginia.gov..

Determine Monthly Digital Media Sales and Dealer’s Discount Factor

● Use digital media sales on Line 3 to determine the dealer’s discount factor.

● If you file more than one return, use the total of digital media sales from all locations.

● If you file on a quarterly basis, divide the taxable sales for all locations by 3.

Digital Media Discount

Monthly Taxable Sales

Factor

(a)

(b)

(c)

At Least

But Less Than

$0

$62,501

.0048

$62,501

$208,001

.0036

$208,001

And Up

.0024

5

6

Fee Due: (Line 4 less Line 5).

6

7

Penalty: The late filing and payment penalty is 6% of Line 6 for each month or part of a month the tax is not paid,

not to exceed 30%. The minimum payment is $10.00, even if tax due is $0.

7

8

Interest: For late filing and payment, interest is assessed on Line 6 at the rate established in Section 6621 of the

Internal Revenue Code of 1954, as amended, plus 2%.

8

9

Total Amount Due: (Add Lines 6, 7 and 8).

9

Return and Payment Filing

Make your check payable to the Department of Taxation.

•

For assistance, call (804) 367-8037.

Department of Taxation

•

Tenemos servicios disponible en Español.

P. O. Box 26627

•

Forms and instructions are available at

Richmond, VA 23261-6627

or by calling (804) 440-2541.

DO NOT mail this worksheet. Detach at dotted line below.

DM-1

Virginia Digital Media Fee Return

(Lodging Industry Only)

(Doc ID 121)

Complete the worksheet above and transfer the entries to the

For assistance, call (804)367-8037

corresponding line numbers on this Form DM-1.

Period

Due Date

1 Gross In-Room Digital Media Sales

Exempt In-Room Digital Media Sales

2

and Other Deductions

0000000000000000 1218888 000000

3 Taxable In-Room Digital Media Sales

4 Digital Media Fee - 10% (Line 3 X .10)

Account Number

5 Dealer’s Discount

FEIN

6 Fee Due (Line 4 less Line 5)

Name

7 Penalty

8 Interest

Address

.

City, State, ZIP

9 Total Amount Due

The declaration and signature line are on the back of the return.

6210107 DM-1AR W REV 7/13

1

1