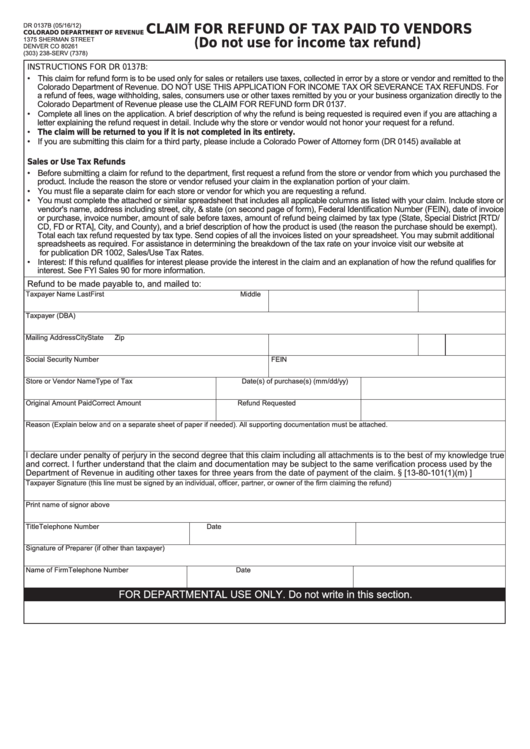

DR 0137B (05/16/12)

CLAIM FOR REFUND OF TAX PAID TO VENDORS

COLORADO DEPARTMENT OF REVENUE

1375 SHERMAN STREET

(Do not use for income tax refund)

DENVER CO 80261

(303) 238-SERV (7378)

INSTRUCTIONS FOR DR 0137B:

• This claim for refund form is to be used only for sales or retailers use taxes, collected in error by a store or vendor and remitted to the

Colorado Department of Revenue. DO NOT USE THIS APPLICATION FOR INCOME TAX OR SEVERANCE TAX REFUNDS. For

a refund of fees, wage withholding, sales, consumers use or other taxes remitted by you or your business organization directly to the

Colorado Department of Revenue please use the CLAIM FOR REFUND form DR 0137.

• Complete all lines on the application. A brief description of why the refund is being requested is required even if you are attaching a

letter explaining the refund request in detail. Include why the store or vendor would not honor your request for a refund.

• The claim will be returned to you if it is not completed in its entirety.

• If you are submitting this claim for a third party, please include a Colorado Power of Attorney form (DR 0145) available at

Sales or Use Tax Refunds

• Before submitting a claim for refund to the department, first request a refund from the store or vendor from which you purchased the

product. Include the reason the store or vendor refused your claim in the explanation portion of your claim.

• You must file a separate claim for each store or vendor for which you are requesting a refund.

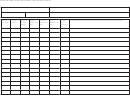

• You must complete the attached or similar spreadsheet that includes all applicable columns as listed with your claim. Include store or

vendor's name, address including street, city, & state (on second page of form), Federal Identification Number (FEIN), date of invoice

or purchase, invoice number, amount of sale before taxes, amount of refund being claimed by tax type (State, Special District [RTD/

CD, FD or RTA], City, and County), and a brief description of how the product is used (the reason the purchase should be exempt).

Total each tax refund requested by tax type. Send copies of all the invoices listed on your spreadsheet. You may submit additional

spreadsheets as required. For assistance in determining the breakdown of the tax rate on your invoice visit our website at

for publication DR 1002, Sales/Use Tax Rates.

• Interest: If this refund qualifies for interest please provide the interest in the claim and an explanation of how the refund qualifies for

interest. See FYI Sales 90 for more information.

Refund to be made payable to, and mailed to:

Taxpayer Name Last

First

Middle

Taxpayer (DBA)

Mailing Address

City

State

Zip

Social Security Number

FEIN

Store or Vendor Name

Type of Tax

Date(s) of purchase(s) (mm/dd/yy)

Original Amount Paid

Correct Amount

Refund Requested

Reason (Explain below and on a separate sheet of paper if needed). All supporting documentation must be attached.

I declare under penalty of perjury in the second degree that this claim including all attachments is to the best of my knowledge true

and correct. I further understand that the claim and documentation may be subject to the same verification process used by the

Department of Revenue in auditing other taxes for three years from the date of payment of the claim. § [13-80-101(1)(m) C.R.S.]

Taxpayer Signature (this line must be signed by an individual, officer, partner, or owner of the firm claiming the refund)

Print name of signor above

Title

Telephone Number

Date

Signature of Preparer (if other than taxpayer)

Name of Firm

Telephone Number

Date

FOR DEPARTMENTAL USE ONLY. Do not write in this section.

1

1 2

2