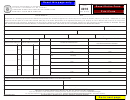

INSTRUCTIONS FOR PREPARING FORM TT–13

MONTHLY REPORT OF CIGARETTE STAMPING AGENT

Purpose

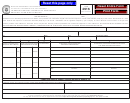

Line 4: Total unstamped cigarette packs sold

during month. Enter the Total from Schedule C,

Form TT-13, Monthly Report of Cigarette Stamping

Parts 1 and 2.

Agent, must be fi led by all Virginia-based entities

that have been granted a Virginia Cigarette Tax

Line 5: Enter the difference between Lines 3 and

Stamping Permit.

Non-Virginia based entities

4.

must fi le a Form TT-14. See separate instructions

Line 6: Enter the total number of cigarette packs

for completing a Form TT-14.

affi xed with a Virginia Revenue stamp during the

A completed TT-13 must be received by the

month from Schedule D.

Department of Taxation by the twentieth of each

Line 7: Enter number of unstamped cigarette

month to report stamping activity for the previous

packs returned to manufacturer during the month

month. All permit holders must fi le a TT-13, even

(Stamped returns would be included in Schedule

if there was no stamping activity for the previous

D totals).

month.

Line 8: Enter the result of Line 5 minus lines 6

Line by Line Instructions

and 7. This is your unstamped cigarette inventory

(in packs) at the end of the month.

Note:

It is recommended that the supporting

schedules be prepared before completing the

Section II–Stamp Movement Reconciliation

Form TT-13.

Please note that all entries are recorded in number

Name and Address: Enter the stamping agent’s

of Revenue Stamps.

full name and physical address (No post offi ce

boxes).

Line 9: Enter your beginning Virginia Cigarette

Revenue Stamp inventory.

This should equal

Month/Year: Enter the month and year for which

Line 14 from the previous month.

you are reporting stamping activity.

Line 10: Enter total number of Virginia Cigarette

Permit Number: Enter the permit number issued

Revenue Stamps purchased during the month, as

to you by the Virginia Department of Taxation.

reported on Schedule B.

Line 11: Enter the sum of lines 9 and 10.

Section I – Cigarette Reconciliation

Line 12: Enter total Virginia Cigarette Revenue

Please note that all entries are recorded in

Stamps affi xed from Column C of Schedule D.

packages of cigarettes (not tax values):

Line 13:

Enter number of Virginia Cigarette

Line 1: Enter in appropriate twenty (20) or twenty-

Revenue Stamps returned to the manufacturer or

fi ve (25) pack columns all unstamped cigarette

Department of Taxation, for credit. Enter any other

packs in inventory on the fi rst day of the reporting

inventory adjustments. Any other adjustments

period.

must be explained in a separate attachment.

Line 2: Enter the number of unstamped packs

Line 14: Enter the result of line 11 minus lines

of cigarettes that were received during the month

12 and 13. This is your ending Virginia Cigarette

(from Schedule A).

Revenue Stamp inventory.

Line 3: Enter the sum of Lines 1 and 2.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8