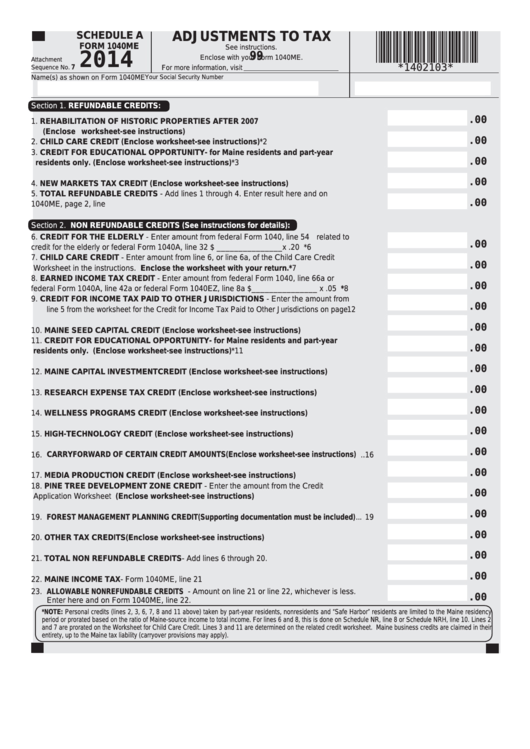

SCHEDULE A

ADJUSTMENTS TO TAX

FORM 1040ME

See instructions.

99

2014

Enclose with your Form 1040ME.

Attachment

7

*1402103*

Sequence No.

For more information, visit

Name(s) as shown on Form 1040ME

Your Social Security Number

Section 1. REFUNDABLE CREDITS:

.00

1.

REHABILITATION OF HISTORIC PROPERTIES AFTER 2007 ................................................ 1

(Enclose worksheet-see instructions)

.00

2.

CHILD CARE CREDIT (Enclose worksheet-see instructions) ..............................................*2

3.

CREDIT FOR EDUCATIONAL OPPORTUNITY- for Maine residents and part-year

.00

residents only. (Enclose worksheet-see instructions) ........................................................*3

.00

4.

NEW MARKETS TAX CREDIT (Enclose worksheet-see instructions) ................................. 4

5.

TOTAL REFUNDABLE CREDITS - Add lines 1 through 4. Enter result here and on

.00

1040ME, page 2, line 25c........................................................................................................... 5

Section 2. NON REFUNDABLE CREDITS (See instructions for details):

6.

CREDIT FOR THE ELDERLY - Enter amount from federal Form 1040, line 54 related to

.00

credit for the elderly or federal Form 1040A, line 32 $ _______________x .20 ........................*6

7.

CHILD CARE CREDIT - Enter amount from line 6, or line 6a, of the Child Care Credit

.00

Worksheet in the instructions. Enclose the worksheet with your return. ..............................*7

8.

EARNED INCOME TAX CREDIT - Enter amount from federal Form 1040, line 66a or

.00

federal Form 1040A, line 42a or federal Form 1040EZ, line 8a $_______________ x .05 .......*8

9.

CREDIT FOR INCOME TAX PAID TO OTHER JURISDICTIONS - Enter the amount from

.00

line 5 from the worksheet for the Credit for Income Tax Paid to Other Jurisdictions on page 12 ...... 9

.00

10. MAINE SEED CAPITAL CREDIT (Enclose worksheet-see instructions) ........................... 10

11. CREDIT FOR EDUCATIONAL OPPORTUNITY- for Maine residents and part-year

.00

residents only. (Enclose worksheet-see instructions) .....................................................*11

.00

12. MAINE CAPITAL INVESTMENT CREDIT (Enclose worksheet-see instructions) ............... 12

.00

13. RESEARCH EXPENSE TAX CREDIT (Enclose worksheet-see instructions) .................... 13

.00

14. WELLNESS PROGRAMS CREDIT (Enclose worksheet-see instructions) ........................ 14

.00

15. HIGH-TECHNOLOGY CREDIT (Enclose worksheet-see instructions) ............................... 15

.00

16. CARRYFORWARD OF CERTAIN CREDIT AMOUNTS (Enclose worksheet-see instructions) .. 16

.00

17. MEDIA PRODUCTION CREDIT (Enclose worksheet-see instructions) ............................. 17

18. PINE TREE DEVELOPMENT ZONE CREDIT - Enter the amount from the Credit

.00

Application Worksheet (Enclose worksheet-see instructions) ............................................ 18

.00

19. FOREST MANAGEMENT PLANNING CREDIT (Supporting documentation must be included) ... 19

.00

20. OTHER TAX CREDITS (Enclose worksheet-see instructions) ............................................ 20

.00

21. TOTAL NON REFUNDABLE CREDITS - Add lines 6 through 20. ........................................... 21

.00

22. MAINE INCOME TAX - Form 1040ME, line 21 ........................................................................ 22

23. ALLOWABLE NONREFUNDABLE CREDITS - Amount on line 21 or line 22, whichever is less.

.00

Enter here and on Form 1040ME, line 22. ................................................................................ 23

*NOTE: Personal credits (lines 2, 3, 6, 7, 8 and 11 above) taken by part-year residents, nonresidents and “Safe Harbor” residents are limited to the Maine residency

period or prorated based on the ratio of Maine-source income to total income. For lines 6 and 8, this is done on Schedule NR, line 8 or Schedule NRH, line 10. Lines 2

and 7 are prorated on the Worksheet for Child Care Credit. Lines 3 and 11 are determined on the related credit worksheet. Maine business credits are claimed in their

entirety, up to the Maine tax liability (carryover provisions may apply).

1

1 2

2