INSTRUCTIONS

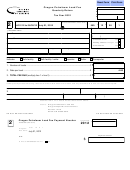

BIN (Oregon business identification number)* required.

Line 2b. Federal employees on business: A federal government em-

Your BIN is a unique identification number issued by us. To avoid

ployee traveling on official government business.

having your tax return and payment rejected, you must enter your

Line 2c Federal instrumentalities: All dwelling units during the

correct BIN. This is not your Social Security Number or FEIN (Fed-

time a federal instrumentality pays for the units. Example: The Red

eral employer identification number). If you don’t know your BIN,

Cross (RC) contracts with several area motels to provide temporary

call us at the numbers listed below.

emergency housing for victims of disasters. Because RC is a federal

Amended return

. If this is an amended return, check “Yes.”

instrumentality, these units are not subject to the state lodging tax.

Mailing address change.

Provide the correct address informa-

If you’re using the online form, calculate totals by tabbing to the

tion on the front of the form and check “Yes.”

next line, pressing the enter key, or simply clicking on another

line. Line 8 shows the total amount of tax due.

Line A: Ownership change.

Check “Yes” if there has been a

Print, sign, and date your return.

change in ownership of this business since the last reporting period

Please do not use red ink on

and provide the following:

your return or voucher. Do not staple your check or money order to

this return. Keep a copy of the tax return for your records.

• Date the business was bought/sold or date business closed.

Mail your return.

Your return can’t be submitted electronically.

• Name and telephone number of the new owner/operator.

You must mail your return with check or money order payable to:

Line B: Final (last return).

Check “Yes” if this business has been

Oregon Lodging Tax

sold or closed since the last reporting period. A final return must be

Oregon Department of Revenue

filed immediately and the tax due must be paid.

PO Box 14110

Line C: Number of taxable rental properties.

Enter the num-

Salem OR 97309-0910

ber of taxable rental properties you are listing under this BIN.

General information.

Each eligible lodging provider is required

Multiple vacation properties: If you are reporting taxable lodging

to register and file a tax return and pay the tax quarterly. The tax is

sales from multiple rental properties under this BIN, you must pro-

imposed on each overnight stay in a temporary dwelling unit used

vide a current list of each of your rental properties. This list must

for human occupancy. ORS 320.305.

include the physical address of each property located in a single

Late filing and payment.

A penalty is imposed if you mail your

region. If you have property in more than one region, you must have

return and pay the tax after the due date. The penalty is 5 percent

a separate BIN and file a separate return for each region.

of the unpaid tax. If you file more than one month after the due

Line D: Number of taxable units/sites/rooms available

Enter

date, an additional 20 percent penalty will be added to the unpaid

the total number of taxable units/sites/rooms available for rent

tax. Interest is imposed on any unpaid tax from the due date un-

during this quarter.

til the date payment in full is received. The current interest rate is

5 percent annually.

Line D example:

A lodging facility has 30 units. During the quar-

ter, one unit was occupied by an on-site manager, three units were

Due date.

Your tax return and payment are due quarterly on April

designated for long-term rental, and one unit was undergoing re-

30, July 31, October 31, and January 31.

modeling. The number of taxable units available this quarter is 25.

What is the applicable law?

ORS 320.315.

Line E: Number of taxable units/sites/rooms actually rented.

Questions?

Enter the total number of taxable units/sites/rooms rented during

this quarter.

To download forms .................

click on “Forms” in the left menu

Line E example:

During the quarter, 25 lodging units were avail-

able. Twenty units were rented full time. Multiply 20 x the number

Oregon Lodging Tax .................................SPA.help@state.or.us

of nights in the quarter. Add to that the number of nights each of

Lodging Tax Tip line (select option one) ......... 503-945-8247

the remaining five units was rented. The total is your number of

Fax (Salem) ........................................................... 503-947-2255

taxable units actually rented.

Please don’t e-mail your confidential information. We can’t guarantee

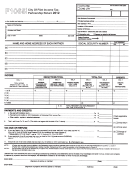

Line 1: Total gross receipts for lodging sales (include in-

e-mail security. Your general tax or policy questions may be e-mailed.

come for all nonoptional fees related to lodging).

Enter the

total gross lodging receipts for the tax reporting quarter on line 1.

General tax information ................ w ww.oregon.gov/dor

You must still file a zero return if there was no tax collected dur-

Salem ............................................................ 503-378-4988

ing the reporting period.

Toll-free from an Oregon prefix .............1-800-356-4222

Line 2: Nontaxable lodging sales.

Note: If you have nontaxable

Asistencia en español:

lodging sales, you must complete lines 2a and/or 2b and/or 2c in the sec-

En Salem o fuera de Oregon ..................... 503-378-4988

tion provided.

Gratis de prefijo de Oregon ....................1-800-356-4222

Line 2a. Long term or monthly rentals: A dwelling unit (site) that

TTY (hearing or speech impaired; machine only):

is rented, leased, or otherwise occupied by the same person for a

consecutive period of 30 days or more. This requirement is satisfied

Salem area or outside Oregon .................. 503-945-8617

even if the physical dwelling unit changes during the consecutive

Toll-free from an Oregon prefix .............1-800-886-7204

period if (a) all dwelling units occupied are within the same facil-

Americans with Disabilities Act (ADA): Call one of the help

ity; and (b) the person paying for the lodging is the same person

numbers above for information in alternative formats.

throughout the consecutive period.

150-604-002-3 (Rev. 03-12)

1

1 2

2 3

3