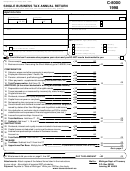

Form 574 - Alaska Fisheries Business Tax Annual Return - 2014 Page 35

ADVERTISEMENT

Schedule PD Recapture Worksheet

Part III

Taxpayer name

EIN/SSN

Fish. Bus. Lic.#

Location/vessel name

Equipment Description

Item

List equipment sold, disposed of or removed from service in the tax period

A

B

C

D

Item (as described above)

A

B

C

D

Month/Year equipment first placed in service

Month/Year equipment sold, disposed of or removed from service

Equipment cost (from Qualified Fees and Expenditures

1

worksheet used to calculate original credit)

2

Original credit generated on this equipment

3

Recapture percentage (see instructions below)

Tentative recapture tax

4

(multiply line 2 by the percentage on line 3)

5

Add all amounts from line 4

Enter on Part I, line 10 in column designated for this license

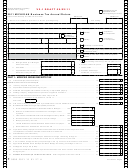

Recapture Provisions

Equipment used to claim a tax credit in a previous tax period that has been sold, disposed of or removed from service in the

state is subject to recapture (payback). The amount of recapture is determined by the length of time the property was in use

in Alaska. If the equipment was sold, disposed of or removed from service in:

the same year it was placed in service or the first year following the year it was placed in service, 100% of the credit

•

must be recaptured (paid back)

the second year following the year it was placed in service, 75% of the credit must be recaptured

•

the third year following the year it was placed in service, 50% of the credit must be recaptured

•

the fourth or subsequent year following the year it was placed in service, none of the credit must be recaptured

•

Equipment used on a vessel is considered to have been removed from the state, and therefore subject to recapture, on the

first day of a tax year in which the Alaska percentage (from page 34) is less than 50% (use Part II to calculate the Alaska

percentage).

0405-574 Rev 01/01/2015 - page 35

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36