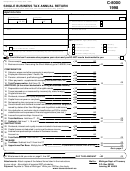

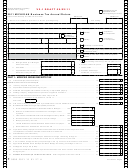

Form 574 - Alaska Fisheries Business Tax Annual Return - 2014 Page 31

ADVERTISEMENT

Taxpayer Name

Federal EIN or SSN

Fisheries Bus. Lic. #

Alaska Fisheries Business Tax Annual Return

Schedule 7

page

of

Schedule 7 Sold Unprocessed in Alaska or Under Exclusion

(AS 43.75.017)

This schedule must be completed for all established and developing fisheries resources caught and sold headed and/or

frozen by fishermen qualifying for the tax exclusion under AS 43.75.017, as well as for unprocessed fisheries resources

sold in Alaska by your company. Use a separate line for each species you sold to each purchaser. Use additional schedules

if more space is needed. Note: salmon must be itemized by subspecies.

(Continued)

Purchaser’s Information

Check box if claiming .017 exclusion

Fish. Bus. Lic. #

Name and Address

.017

Species

Species Code

Pounds

Page total

Schedule 7 total from page 30 and this page

0405-574 Rev 01/01/2015 - page 31

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36