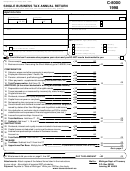

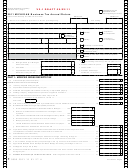

Form 574 - Alaska Fisheries Business Tax Annual Return - 2014 Page 24

ADVERTISEMENT

Taxpayer Name

Federal EIN or SSN

Fisheries Bus. Lic. #

Alaska Fisheries Business Tax Annual Return

Schedule 5E

page

of

Schedule 5E Established: Custom Processed by/for Unlicensed Companies

This schedule must be completed for all established fisheries resources that your company 1) had custom-processed by,

or 2) custom processed for, someone other than a licensed fisheries business. Use additional schedules if more space

is needed. Note: The applicable tax rate (floating or shore-based) depends on the status of the company that

performed the custom processing.

A. Floating Facility

Note: Salmon must be itemized by sub-species.

Processing

Location Code

Customer’s Name & Address

Species

Species Code

Pounds

Value

(see instructions)

Totals. Enter total value on page 2, part 1, line 5, column A

B. Shore-based Salmon Cannery

Processing

Species

Location Code

Customer’s Name & Address

Species

Pounds

Value

Code

King

4

1

0

Red

4

2

0

Coho

4

3

0

Pink

4

4

0

Chum

4

5

0

Totals. Enter total value on page 2, part 1, line 5, column B

C. Shore-based Facility

Note: Salmon must be itemized by sub-species.

Processing

Species

Location Code

Customer’s Name & Address

Species

Pounds

Value

Code

Section C page totals. If finished, enter total value on page 2,

part 1, line 5, column C

0405-574 Rev 01/01/2015 - page 24

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36