Form 574 - Alaska Fisheries Business Tax Annual Return - 2014 Page 23

ADVERTISEMENT

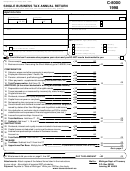

Taxpayer Name

Federal EIN or SSN

Fisheries Bus. Lic. #

Alaska Fisheries Business Tax Annual Return

Schedule 4D

page

of

Schedule 4D Developing: Custom Processed by Others

This schedule must be completed for all developing fisheries resources that your company had custom processed by

another licensed fisheries business. Use additional schedules if more space is needed. Note: the applicable tax rate

(floating or shore-based) depends on the status of the company or individual who custom processed for you.

A. Floating Facility

Note: Direct Marketer license holders use section C.

Processing

Species

Fisheries Processor’s

Location Code

Waters

Species

Pounds

Value

Code

Lic#

Name

(see instructions)

Totals. Enter total value on page 2, part 2, line 4, column A

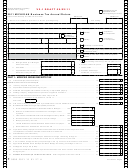

B. Shore-based Facility and Direct Marketer License Holders

Fisheries Processor’s

Species

Processing

Waters

Species

Pounds

Value

Code

Location Code

Lic#

Name

Totals. Enter total value on page 2, part 2, line 4, column B

0405-574 Rev 01/01/2015 - page 23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36