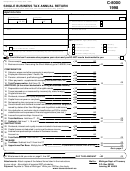

Form 574 - Alaska Fisheries Business Tax Annual Return - 2014 Page 2

ADVERTISEMENT

Federal EIN or SSN

Fisheries Bus. Lic. #

Taxpayer name

Alaska Fisheries Business Tax Annual Return

Note: First complete schedules 1-5 as appropriate for your fisheries business, then transfer the totals to Part 1 & Part 2 below.

Part 1: Established

Column B

Column C

Column A

Shore-based Salmon

Shore-based Facility and

Floating Facility

Schedule

Cannery

DM License Holder

1 1E Caught and processed

2 2E Purchased and processed

3 3E Transported unprocessed

4 4E Custom processed by others

5 5E Custom processed (unlicensed)

6 Total Value. Add schedules 1-5

Tax rate

5% (.05)

4.5% (.045)

3% (.03)

7 Tax. Multiply line 6 by tax rate

Department use only

60621

60622

60623

8. Established Fisheries Business Tax. Add each entry from line 7. Enter on page 1, line 1a

Part 2: Developing

Column B

Column A

Shore-based Facility and

Floating Facility

Schedule

DM License Holder

1 1D Caught and processed

2 2D Purchased and processed

3 3D Transported unprocessed

4 4D Custom processed by others

5 5D Custom processed (unlicensed)

6 Total Value. Add schedules 1-5

Tax rate

3% (.03)

1% (.01)

7 Tax. Multiply line 6 by tax rate

Department use only

60624

60625

8. Developing Fisheries Business Tax. Add each entry from line 7. Enter on page 1, line 1b

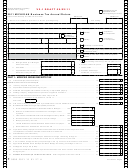

Part 3: Estimated Payments

Payment Date

Amount

Payment Date

Amount

Payment Date

Amount

9. Total estimated payments from all Amount columns above

10. Overpayment carryover from line 8b of previous Alaska Fisheries Business Tax Return

11. AMENDED AND BONUS RETURNS ONLY - Taxes previously paid for this year

12. Total payments. Add lines 9, 10 and 11. Enter on page 1, line 6

0405-574 Rev 01/01/2015 - page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34 35

35 36

36