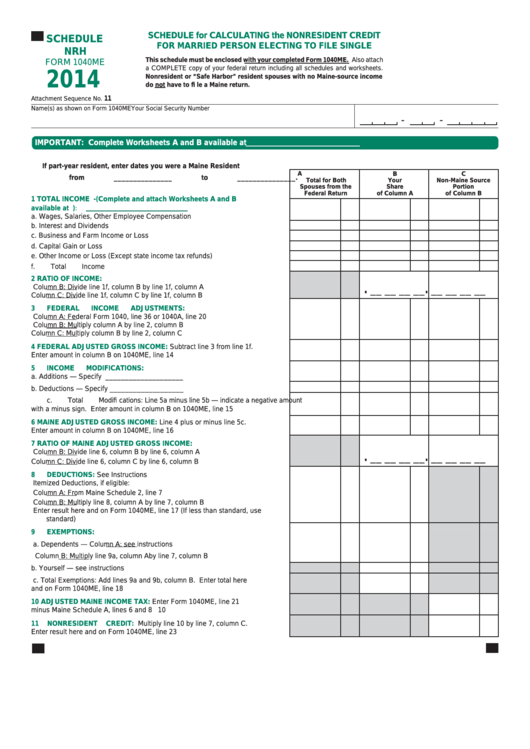

SCHEDULE for CALCULATING the NONRESIDENT CREDIT

SCHEDULE

FOR MARRIED PERSON ELECTING TO FILE SINGLE

NRH

This schedule must be enclosed with your completed Form 1040ME. Also attach

FORM 1040ME

a COMPLETE copy of your federal return including all schedules and worksheets.

2014

Nonresident or “Safe Harbor” resident spouses with no Maine-source income

do not have to fi le a Maine return.

11

Attachment Sequence No.

Name(s) as shown on Form 1040ME

Your Social Security Number

-

-

IMPORTANT: Complete Worksheets A and B available at before completing Schedule NRH.

If part-year resident, enter dates you were a Maine Resident

A

B

C

from _______________ to _______________ .

Total for Both

Your

Non-Maine Source

Spouses from the

Share

Portion

of Column B

Federal Return

of Column A

1

TOTAL INCOME - (Complete and attach Worksheets A and B

available at ):

a. Wages, Salaries, Other Employee Compensation .................................... 1a

b. Interest and Dividends ............................................................................... 1b

c. Business and Farm Income or Loss .......................................................... 1c

d. Capital Gain or Loss .................................................................................. 1d

e. Other Income or Loss (Except state income tax refunds) ......................... 1e

f.

Total Income ............................................................................................... 1f

2

RATIO OF INCOME:

Column B: Divide line 1f, column B by line 1f, column A

.

.

__ __ __ __

__ __ __ __

Column C: Divide line 1f, column C by line 1f, column B .................................. 2

3

FEDERAL INCOME ADJUSTMENTS:

Column A: Federal Form 1040, line 36 or 1040A, line 20

Column B: Multiply column A by line 2, column B

Column C: Multiply column B by line 2, column C ............................................. 3

4

FEDERAL ADJUSTED GROSS INCOME:

Subtract line 3 from line 1f.

Enter amount in column B on 1040ME, line 14 ................................................. 4

5

INCOME MODIFICATIONS:

a. Additions — Specify ____________________

..................................... 5a

b. Deductions — Specify ___________________

..................................... 5b

c. Total Modifi cations: Line 5a minus line 5b — indicate a negative amount

with a minus sign. Enter amount in column B on 1040ME, line 15 .......... 5c

6

MAINE ADJUSTED GROSS INCOME:

Line 4 plus or minus line 5c.

Enter amount in column B on 1040ME, line 16 ................................................. 6

7

RATIO OF MAINE ADJUSTED GROSS INCOME:

Column B: Divide line 6, column B by line 6, column A

.

.

__ __ __ __

__ __ __ __

Column C: Divide line 6, column C by line 6, column B .................................... 7

8

DEDUCTIONS:

See Instructions

Itemized Deductions, if eligible:

Column A: From Maine Schedule 2, line 7

Column B: Multiply line 8, column A by line 7, column B

Enter result here and on Form 1040ME, line 17 (If less than standard, use

standard) ........................................................................................................... 8

9

EXEMPTIONS:

a. Dependents — Column A: see instructions

Column B: Multiply line 9a, column A by line 7, column B ......................... 9a

b. Yourself — see instructions ....................................................................... 9b

c. Total Exemptions: Add lines 9a and 9b, column B. Enter total here

and on Form 1040ME, line 18 ................................................................... 9c

10

ADJUSTED MAINE INCOME TAX:

Enter Form 1040ME, line 21

minus Maine Schedule A, lines 6 and 8 ......................................................... 10

11

NONRESIDENT CREDIT:

Multiply line 10 by line 7, column C.

Enter result here and on Form 1040ME, line 23 ............................................. 11

1

1 2

2