Form Rev 27 - Washington Motion Picture And Video Production Business Exemption Certificate

ADVERTISEMENT

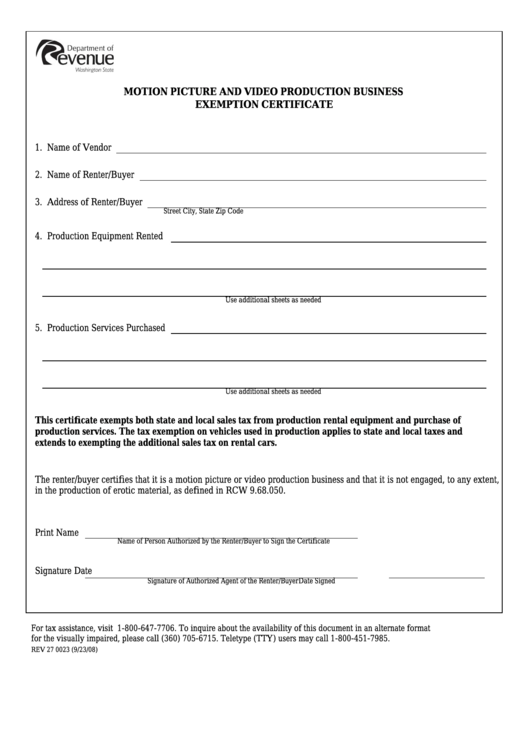

MOTION PICTURE AND VIDEO PRODUCTION BUSINESS

EXEMPTION CERTIFICATE

1. Name of Vendor

2. Name of Renter/Buyer

3. Address of Renter/Buyer

Street

City, State

Zip Code

4. Production Equipment Rented

Use additional sheets as needed

5. Production Services Purchased

Use additional sheets as needed

This certificate exempts both state and local sales tax from production rental equipment and purchase of

production services. The tax exemption on vehicles used in production applies to state and local taxes and

extends to exempting the additional sales tax on rental cars.

The renter/buyer certifies that it is a motion picture or video production business and that it is not engaged, to any extent,

in the production of erotic material, as defined in RCW 9.68.050.

Print Name

Name of Person Authorized by the Renter/Buyer to Sign the Certificate

Signature

Date

Signature of Authorized Agent of the Renter/Buyer

Date Signed

For tax assistance, visit dor.wa.gov or call 1-800-647-7706. To inquire about the availability of this document in an alternate format

for the visually impaired, please call (360) 705-6715. Teletype (TTY) users may call 1-800-451-7985.

REV 27 0023 (9/23/08)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1