Reset

Print

DEPARTMENT USE ONLY

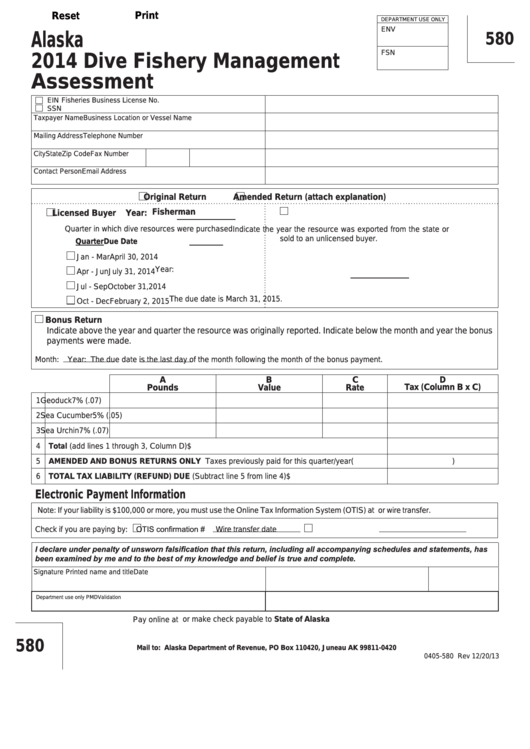

Alaska

ENV

580

FSN

2014 Dive Fishery Management

Assessment

EIN

Fisheries Business License No.

SSN

Taxpayer Name

Business Location or Vessel Name

Mailing Address

Telephone Number

City

State

Zip Code

Fax Number

Contact Person

Email Address

Original Return

Amended Return (attach explanation)

Fisherman

Licensed Buyer

Year:

Quarter in which dive resources were purchased

Indicate the year the resource was exported from the state or

sold to an unlicensed buyer.

Quarter

Due Date

Jan - Mar

April 30, 2014

Year:

Apr - Jun

July 31, 2014

Jul - Sep

October 31,2014

Oct - Dec

February 2, 2015

The due date is March 31, 2015.

Bonus Return

Indicate above the year and quarter the resource was originally reported. Indicate below the month and year the bonus

payments were made.

Month:

Year:

The due date is the last day of the month following the month of the bonus payment.

A

B

C

D

Tax (Column B x C)

Pounds

Value

Rate

1

Geoduck

7% (.07)

2

Sea Cucumber

5% (.05)

3

Sea Urchin

7% (.07)

Total (add lines 1 through 3, Column D)

4

$

5

AMENDED AND BONUS RETURNS ONLY Taxes previously paid for this quarter/year

(

)

6

TOTAL TAX LIABILITY (REFUND) DUE (Subtract line 5 from line 4)

$

Electronic Payment Information

Note: If your liability is $100,000 or more, you must use the Online Tax Information System (OTIS) at or wire transfer.

Check if you are paying by:

OTIS confirmation #

Wire transfer date

I declare under penalty of unsworn falsification that this return, including all accompanying schedules and statements, has

been examined by me and to the best of my knowledge and belief is true and complete.

Signature

Printed name and title

Date

Department use only PMD

Validation

Pay online at or make check payable to State of Alaska

580

Mail to: Alaska Department of Revenue, PO Box 110420, Juneau AK 99811-0420

0405-580 Rev 12/20/13

1

1