Print

Clear

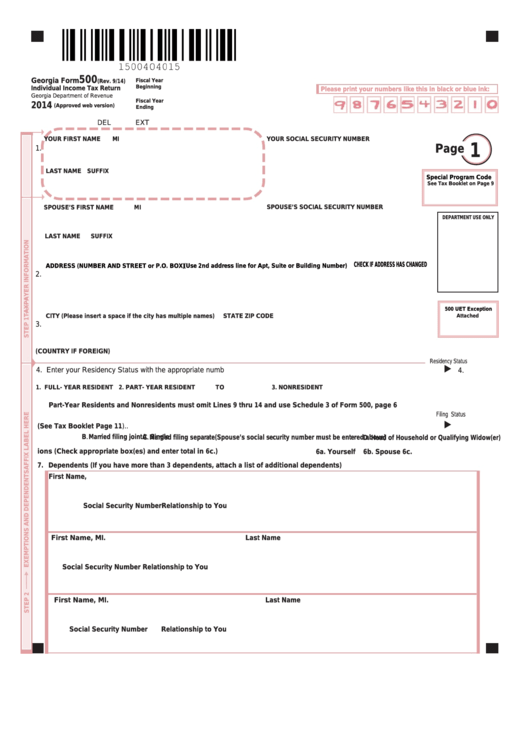

500

Fiscal Year

Georgia Form

(Rev. 9 /14)

Beginning

Individual Income Tax Return

Please print your numbers like this in black or blue ink:

Please print your numbers like this in black or blue ink:

Georgia Department of Revenue

Fiscal Year

2014

version)

(Approved web version)

Ending

DEL

EXT

YOUR FIRST NAME

MI

YOUR SOCIAL SECURITY NUMBER

1

Page

1.

LAST NAME

SUFFIX

Special Program Code

See Tax Booklet on Page 9

SPOUSE’S SOCIAL SECURITY NUMBER

SPOUSE’S FIRST NAME

MI

DEPARTMENT USE ONLY

LAST NAME

SUFFIX

CHECK IF ADDRESS HAS CHANGED

(Use 2nd address line for Apt, Suite or Building Number)

ADDRESS (NUMBER AND STREET or P.O. BOX)

2.

500 UET Exception

CITY (Please insert a space if the city has multiple names)

STATE

ZIP CODE

Attached

3.

(COUNTRY IF FOREIGN)

Residency Status

4. Enter your Residency Status with the appropriate number.................................................................................................................

4.

1. FULL- YEAR RESIDENT

2. PART- YEAR RESIDENT

TO

3. NONRESIDENT

Part-Year Residents and Nonresidents must omit Lines 9 thru 14 and use Schedule 3 of Form 500, page 6

Filing Status

5. Enter Filing Status with appropriate letter (See Tax Booklet Page 11 )..................................................................................

5.

A. Single

B.Married filing joint

C.Married filing separate(Spouse’s social security number must be entered above)

D. Head of Household or Qualifying Widow(er)

6. Number of exemptions (Check appropriate box(es) and enter total in 6c.)

6a. Yourself

6b. Spouse

6c.

7. Dependents (If you have more than 3 dependents, attach a list of additional dependents)

First Name, MI.

Last Name

Social Security Number

Relationship to You

First Name, MI.

Last Name

Social Security Number

Relationship to You

First Name, MI.

Last Name

Social Security Number

Relationship to You

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11