RPD-41361

State of New Mexico - Taxation and Revenue Department

Rev. 10/22/2014

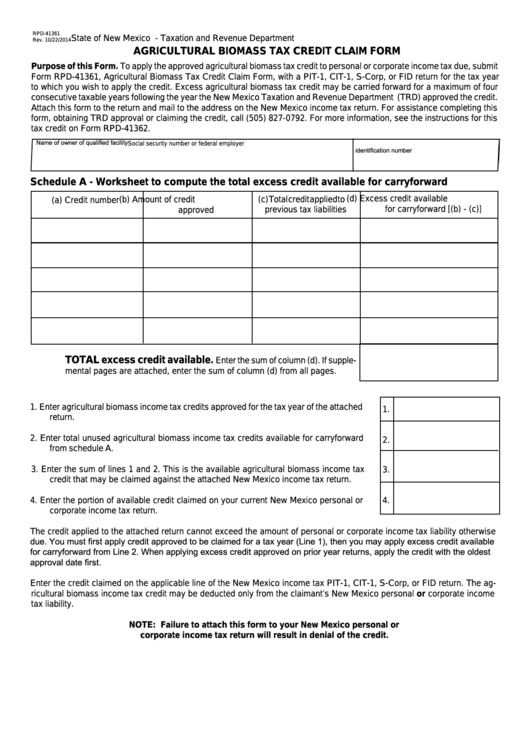

AGRICULTURAL BIOMASS TAX CREDIT CLAIM FORM

Purpose of this Form. To apply the approved agricultural biomass tax credit to personal or corporate income tax due, submit

Form RPD-41361, Agricultural Biomass Tax Credit Claim Form, with a PIT-1, CIT-1, S-Corp, or FID return for the tax year

to which you wish to apply the credit. Excess agricultural biomass tax credit may be carried forward for a maximum of four

consecutive taxable years following the year the New Mexico Taxation and Revenue Department (TRD) approved the credit.

Attach this form to the return and mail to the address on the New Mexico income tax return. For assistance completing this

form, obtaining TRD approval or claiming the credit, call (505) 827-0792. For more information, see the instructions for this

tax credit on Form RPD-41362.

Name of owner of qualified facility

Social security number or federal employer

identification number

Schedule A - Worksheet to compute the total excess credit available for carryforward

(d) Excess credit available

(b) Amount of credit

(c) Total credit applied to

(a) Credit number

for carryforward [(b) - (c)]

previous tax liabilities

approved

Enter the sum of column (d). If supple-

TOTAL excess credit available.

mental pages are attached, enter the sum of column (d) from all pages.

1.

Enter agricultural biomass income tax credits approved for the tax year of the attached

1.

return.

2.

Enter total unused agricultural biomass income tax credits available for carryforward

2.

from schedule A.

3.

Enter the sum of lines 1 and 2. This is the available agricultural biomass income tax

3.

credit that may be claimed against the attached New Mexico income tax return.

4.

Enter the portion of available credit claimed on your current New Mexico personal or

4.

corporate income tax return.

The credit applied to the attached return cannot exceed the amount of personal or corporate income tax liability otherwise

due. You must first apply credit approved to be claimed for a tax year (Line 1), then you may apply excess credit available

for carryforward from Line 2. When applying excess credit approved on prior year returns, apply the credit with the oldest

approval date first.

Enter the credit claimed on the applicable line of the New Mexico income tax PIT-1, CIT-1, S-Corp, or FID return. The ag-

ricultural biomass income tax credit may be deducted only from the claimant’s New Mexico personal or corporate income

tax liability.

NOTE: Failure to attach this form to your New Mexico personal or

corporate income tax return will result in denial of the credit.

1

1