PRINT FORM

CLEAR FIELDS

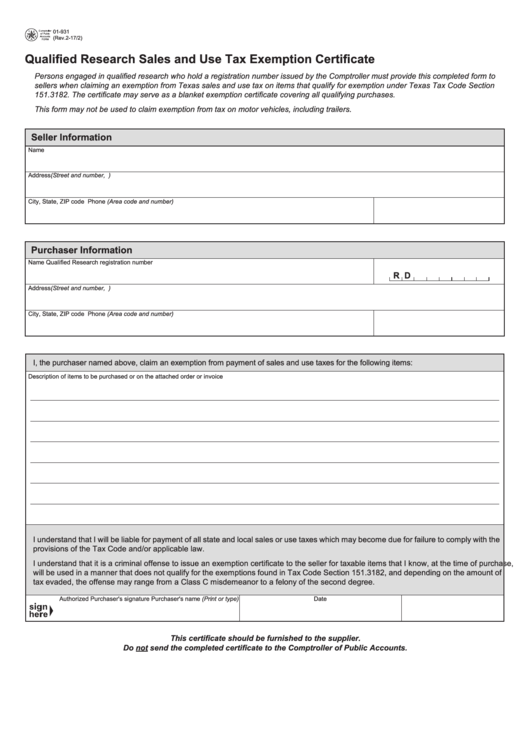

01-931

(Rev.2-17/2)

Qualified Research Sales and Use Tax Exemption Certificate

Persons engaged in qualified research who hold a registration number issued by the Comptroller must provide this completed form to

sellers when claiming an exemption from Texas sales and use tax on items that qualify for exemption under Texas Tax Code Section

151.3182. The certificate may serve as a blanket exemption certificate covering all qualifying purchases.

This form may not be used to claim exemption from tax on motor vehicles, including trailers.

Seller Information

Name

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Phone (Area code and number)

Purchaser Information

Name

Qualified Research registration number

R D

Address (Street and number, P.O. Box or route number)

City, State, ZIP code

Phone (Area code and number)

I, the purchaser named above, claim an exemption from payment of sales and use taxes for the following items:

Description of items to be purchased or on the attached order or invoice

I understand that I will be liable for payment of all state and local sales or use taxes which may become due for failure to comply with the

provisions of the Tax Code and/or applicable law.

I understand that it is a criminal offense to issue an exemption certificate to the seller for taxable items that I know, at the time of purchase,

will be used in a manner that does not qualify for the exemptions found in Tax Code Section 151.3182, and depending on the amount of

tax evaded, the offense may range from a Class C misdemeanor to a felony of the second degree.

Authorized Purchaser's signature

Purchaser's name (Print or type)

Date

This certificate should be furnished to the supplier.

Do not send the completed certificate to the Comptroller of Public Accounts.

1

1 2

2