Arizona Form 309 Instructions - Credit For Taxes Paid To Another State Or Country - 2014 Page 6

ADVERTISEMENT

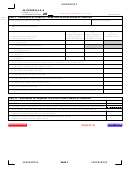

Arizona Form 309

EXAMPLE:

The following example will illustrate how to figure a credit for taxes paid to another state.

Facts: Mr. and Mrs. F are Arizona residents who derive income from a farm in State XY. During the taxable year for

which the credit is being claimed, Mr. and Mrs. F had the following income.

Interest income

$ 38,000

Dividend income

$

4,000

Farm income from State XY

$ 16,000

Total income

$ 58,000

As Reported on Arizona Return

Federal adjusted gross income

$ 58,000

Less dependent exemption $2,300

(2,300)

Arizona adjusted gross income

$ 55,700

Itemized deductions

(12,000)

Personal exemptions

(6,300)

Arizona taxable income

37,400

Arizona tax

1,020

Credit for Contributions to Public Schools

(300)

Arizona tax liability

720

As Reported on State XY Return

As Reported on State XY Income Allocation Schedule

Column A

Column B

Income from

Income from Column

1. Federal adjusted gross

federal return

A from State XY

income

$ 58,000

sources

2. Plus State XY additions

0

1. Wages

3. Less State XY

0

2. Interest

38,000

subtractions

4. State XY adjusted gross

$ 58,000

3. Dividends

4,000

income

5. Itemized Deductions

(11,000)

4. Farm Income

16,000

16,000

6. Exemptions

(3,000)

5. Capital Gains

7. State XY taxable

$ 44,000

6. Rents, Sub S, Royalties,

income

Partnership

8. State XY tax

1,760

9. Percentage from

0.2759

7. Other Income

Income Allocation

Schedule

10. State XY tax on income

$

486

8. Total income

58,000

16,000

sourced to State XY.

Multiply line 8 by line

9.

9. Tax proration Divide line

16,000/58,000 = .2759

8 Column B by Line 8,

Column A

6

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10