Arizona Form 309 Instructions - Credit For Taxes Paid To Another State Or Country - 2014 Page 4

ADVERTISEMENT

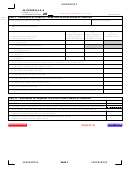

Arizona Form 309

As Reported on State X Return

As Reported on Arizona Return

Federal adjusted gross income

$ 45,000

Federal adjusted gross income

$ 45,000

Less non-state X income (military & rental

$ (35,000)

Less subtractions from income (military

$ (17,300)

income)

income of $15,000 and dependent exemption

of $2,300)

Less subtraction for second job income

$ (1,000)

Arizona adjusted gross income

$ 27,700

State X adjusted gross income

$

9,000

Mr. and Mrs. M must include Mr. M’s part-time employment wages of $10,000 in both the Arizona gross income and the State

X’s equivalent of Arizona gross income. Therefore, the amount of wage income reportable to both Arizona and State X is

$10,000. For Arizona purposes, there are no additions or subtractions related to that $10,000 wage income included in Arizona

gross income, so the entire $10,000 of wage income is included in Arizona adjusted gross income. However, under State X law,

$1,000 of the $10,000 wage income is subtracted from State X’s equivalent of Arizona adjusted gross income, so only $9,000 of

that $10,000 is included in State X’s equivalent of Arizona adjusted gross income.

Mr. and Mrs. M complete lines 1 through 6

of Form 309 as follows:

(a)

1. Description of income items

wages

2. Amount of income from item listed on line 1, reportable to both Arizona and the other state or country.

$10,000

3.

Portion of income on line 2 included in Arizona adjusted gross income.

$10,000

4. Portion of income included on line 2 included in the other state’s or country’s equivalent of Arizona

$ 9,000

adjusted gross income.

5. Income subject to tax by both Arizona and the other state or country. Enter the smaller of the amount

$ 9,000

entered on line 3 or 4.

6. Total income subject to tax in both Arizona and the other state or country.

$ 9,000

Line 9 - Entire Income Upon Which Arizona

Part 2 - Computation of Other State or

Tax is Imposed

Country Tax Credit

Enter your entire income upon which Arizona tax is

Line 7 -

imposed. This is the Arizona adjusted gross income

excluding allowable exemptions for age 65 or over, blind,

Enter your Arizona tax liability less any credits. However,

dependents, or qualifying parents and grandparents.

do not reduce your Arizona tax liability by the other state tax

credit.

Use the appropriate worksheet below to figure your entire

income upon which Arizona tax is imposed.

For 2014, your Arizona tax liability prior to tax credits can

be found on the following line number.

Worksheet for Arizona Residents

Arizona Form

Line Number

1.

Enter the amount from

Arizona Form 140,

140

46

page 2, line 42.

140PY

59

2.

Enter the total amount

140NR

56

from Arizona Form

140X

30

140, page 2, lines 38

through 41.

NOTE: If you are taking other tax credits, you must reduce

3. Add the amount on

your Arizona tax by the amount of those other tax credits.

lines 1 and 2. Enter

For the purpose of this computation, be sure to reduce your

the total here and on

Arizona tax by both refundable and nonrefundable credits.

line 9 of Form 309.

Line 8

-

Enter amount from Part I, line 6.

4

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10