Arizona Form 309 Instructions - Credit For Taxes Paid To Another State Or Country - 2014 Page 10

ADVERTISEMENT

Arizona Form 309

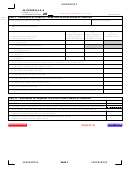

Part II – Computation of Other State or Country Tax Credit

7. Arizona tax liability less any credits (except other state tax credit)…………………………………………….. 7

1,933

8. Amount from Part I, line 6……………………………………………………………………………………..... 8

47,000

9. ** Entire income upon which Arizona income tax is imposed……………………………………………......... 9

87,000

10. Divide the amount on line 8 by the amount on line 9 (cannot be greater than

)……………………………...... 10

.5402

1

11. Multiply the amount on line 7 by the decimal on line 10……………………………………………………….. 11

1,044

12. Income tax paid to State Z (tax less credits)…………………………………………………………………...... 12

2,154

13. Amount from Part I, line 6……………………………………………………………………………………..... 13

47,000

14. ***Entire income upon which State Z’s income tax is imposed……………………………………………....... 14

68,875

15. Divide the amount on line 13 by the amount on line 14 (cannot be greater than 1)…………………………...... 15

.6824

16. Multiply the amount on line 12 by the decimal on line 15…………………………………………………........ 16

1,470

17. Other state or country tax credit. Enter the smaller of line 11 or line 16……………………………………..... 17

1,044

* Lines 1 through 6 – Income subject to tax in both Arizona and State XY

Before completing lines 1 through 6, Mr. and Mrs. R must complete page 2 of Arizona Form 309, Schedule of Income Allocation.

Even though Mr. and Mrs. R must report wage income, interest income and rental income to State Z, only the wage income earned

for services performed in State Z would be sourced to State Z if State Z were taxing Mr. and Mrs. R as nonresidents. Therefore,

when Mr. and Mrs. R complete the Schedule of Income Allocation, Mr. and Mrs. R indicate that only $47,000 of wages would be

sourced to State Z as income of a nonresident of State Z.

Mr. and Mrs. R must report State Z wages of $47,000 in Arizona gross income and $47,000 of State Z wages in State Z’s

equivalent of Arizona gross income. There are no additions or subtractions related to the $47,000 of State Z wages required under

either Arizona law, or State Z law. Therefore, $47,000 of State Z wage income is included in Arizona adjusted gross income and

$47,000 of State Z wage income is included in State Z’s equivalent of Arizona adjusted gross income.

**Line 9 – Entire income upon which Arizona tax is imposed

For the purpose of the credit, Mr. and Mrs. R compute the entire income upon which Arizona tax is imposed as follows:

Arizona adjusted gross income

$ 84,700

Plus dependent, blind, age 65 or over, and qualifying

parent and grandparent exemptions

2,300

Entire income upon which Arizona income tax is imposed

$ 87,000

***Line 14 – Entire income upon which State Z tax is imposed

This is the entire income upon which State Z tax is imposed. This is State Z’s equivalent of Arizona adjusted gross income for

these individuals. For the purpose of the credit, Mr. and Mrs. R compute the entire income upon which State Z tax is imposed as

follows:

State Z’s equivalent of Arizona adjusted gross income

$ 64,875

State Z’s equivalent of Arizona’s dependent exemptions

4,000

Entire income upon which State Z’s tax is imposed

$ 68,875

List of State Abbreviations

State

State

State

State

Alabama

AL

Indiana

IN

Mississippi

MS

Oklahoma

OK

Arkansas

AR

Iowa

IA

Missouri

MO

Oregon

OR

California

Kansas

Montana

Pennsylvania

CA

KS

MT

PA

Colorado

CO

Kentucky

KY

Nebraska

NE

Rhode Island

RI

Connecticut

Louisiana

New Jersey

South Carolina

CT

LA

NJ

SC

Delaware

DE

Maine

ME

New Mexico

NM

Utah

UT

Georgia

GA

Maryland

MD

New York

NY

Vermont

VT

Hawaii

HI

Massachusetts

MA

North Carolina

NC

Virginia

VA

Idaho

ID

Michigan

MI

North Dakota

ND

West Virginia

WV

Illinois

IL

Minnesota

MN

Ohio

OH

Wisconsin

WI

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10