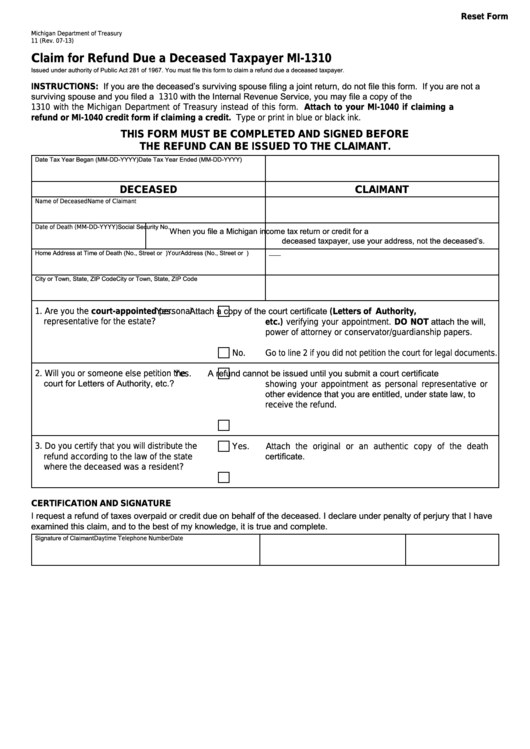

Reset Form

Michigan Department of Treasury

11 (Rev. 07-13)

Claim for Refund Due a Deceased Taxpayer MI-1310

Issued under authority of Public Act 281 of 1967. You must file this form to claim a refund due a deceased taxpayer.

INSTRUCTIONS: If you are the deceased’s surviving spouse filing a joint return, do not file this form. If you are not a

surviving spouse and you filed a U.S. Form 1310 with the Internal Revenue Service, you may file a copy of the

U.S. Form 1310 with the Michigan Department of Treasury instead of this form. Attach to your MI-1040 if claiming a

refund or MI-1040 credit form if claiming a credit. Type or print in blue or black ink.

THIS FORM MUST BE COMPLETED AND SIGNED BEFORE

THE REFUND CAN BE ISSUED TO THE CLAIMANT.

Date Tax Year Began (MM-DD-YYYY)

Date Tax Year Ended (MM-DD-YYYY)

DECEASED

CLAIMANT

Name of Deceased

Name of Claimant

Social Security No.

Date of Death (MM-DD-YYYY)

When you file a Michigan income tax return or credit for a

deceased taxpayer, use your address, not the deceased’s.

Home Address at Time of Death (No., Street or P.O. Box)

Your Address (No., Street or P.O. Box)

City or Town, State, ZIP Code

City or Town, State, ZIP Code

Attach a copy of the court certificate (Letters of Authority,

1. Are you the court-appointed personal

Yes.

etc.) verifying your appointment. DO NOT attach the will,

representative for the estate?

power of attorney or conservator/guardianship papers.

No.

Go to line 2 if you did not petition the court for legal documents.

A refund cannot be issued until you submit a court certificate

2. Will you or someone else petition the

Yes.

court for Letters of Authority, etc.?

showing your appointment as personal representative or

other evidence that you are entitled, under state law, to

receive the refund.

No.

Go to line 3.

3. Do you certify that you will distribute the

Yes.

Attach the original or an authentic copy of the death

certificate.

refund according to the law of the state

where the deceased was a resident?

No.

Refund cannot be paid to claimant.

CERTIFICATION AND SIGNATURE

I request a refund of taxes overpaid or credit due on behalf of the deceased. I declare under penalty of perjury that I have

examined this claim, and to the best of my knowledge, it is true and complete.

Signature of Claimant

Daytime Telephone Number

Date

1

1