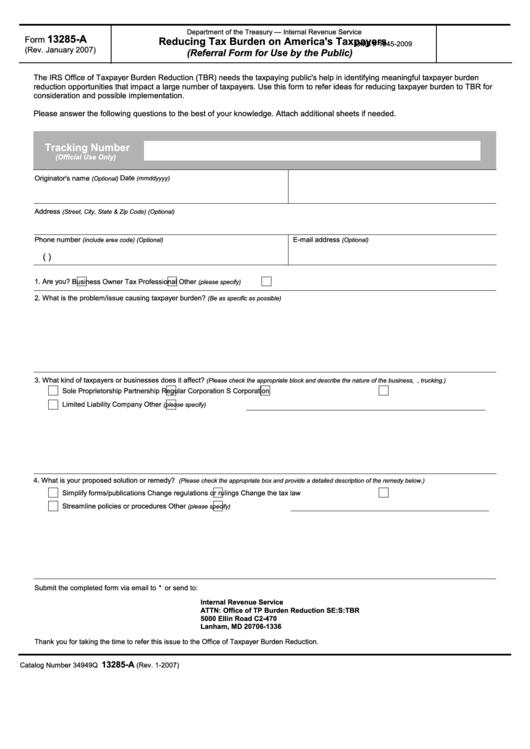

Department of the Treasury — Internal Revenue Service

13285-A

Form

Reducing Tax Burden on America's Taxpayers

OMB # 1545-2009

(Rev. January 2007)

(Referral Form for Use by the Public)

The IRS Office of Taxpayer Burden Reduction (TBR) needs the taxpaying public's help in identifying meaningful taxpayer burden

reduction opportunities that impact a large number of taxpayers. Use this form to refer ideas for reducing taxpayer burden to TBR for

consideration and possible implementation.

Please answer the following questions to the best of your knowledge. Attach additional sheets if needed.

Tracking Number

(Official Use Only)

Date

Originator's name

(Optional)

(mmddyyyy)

Address

(Street, City, State & Zip Code) (Optional)

Phone number

E-mail address

(include area code) (Optional)

(Optional)

(

)

1. Are you?

Business Owner

Tax Professional

Other

(please specify)

2. What is the problem/issue causing taxpayer burden?

(Be as specific as possible)

3. What kind of taxpayers or businesses does it affect?

(Please check the appropriate block and describe the nature of the business, i.e. restaurant, trucking.)

Sole Proprietorship

Partnership

Regular Corporation

S Corporation

Limited Liability Company

Other

(please specify)

4. What is your proposed solution or remedy?

(Please check the appropriate box and provide a detailed description of the remedy below.)

Simplify forms/publications

Change regulations or rulings

Change the tax law

Streamline policies or procedures

Other

(please specify)

Submit the completed form via email to *sbse.otpbr@irs.gov or send to:

Internal Revenue Service

ATTN: Office of TP Burden Reduction SE:S:TBR

5000 Ellin Road C2-470

Lanham, MD 20706-1336

Thank you for taking the time to refer this issue to the Office of Taxpayer Burden Reduction.

13285-A

Catalog Number 34949Q

Page 1 of 2

Form

(Rev. 1-2007)

1

1 2

2