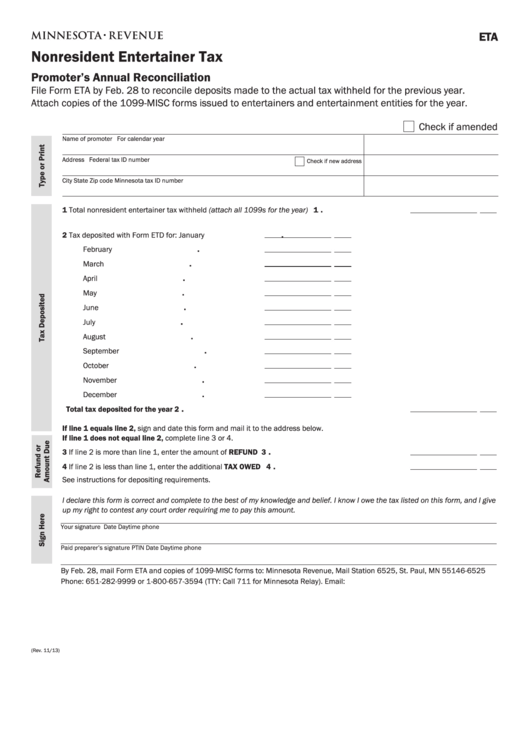

ETA

Nonresident Entertainer Tax

Promoter’s Annual Reconciliation

File Form ETA by Feb . 28 to reconcile deposits made to the actual tax withheld for the previous year .

Attach copies of the 1099-MISC forms issued to entertainers and entertainment entities for the year .

Check if amended

Name of promoter

For calendar year

Address

Federal tax ID number

Check if new address

City

State

Zip code

Minnesota tax ID number

.

1 Total nonresident entertainer tax withheld (attach all 1099s for the year) . . . . . . . . . . . . . . . . . . . . . . 1

.

2 Tax deposited with Form ETD for:

January . . . . . . . . . .

.

February . . . . . . . . .

.

March . . . . . . . . . . .

.

April . . . . . . . . . . . .

.

May . . . . . . . . . . . . .

.

June . . . . . . . . . . . .

.

July . . . . . . . . . . . . .

.

August . . . . . . . . . .

.

September . . . . . . .

.

October . . . . . . . . . .

.

November . . . . . . . .

.

December . . . . . . .

.

Total tax deposited for the year . . . . . . . . . . . . . . . . . . . . . . . . . 2

If line 1 equals line 2, sign and date this form and mail it to the address below .

If line 1 does not equal line 2, complete line 3 or 4 .

.

3 If line 2 is more than line 1, enter the amount of REFUND . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

.

4 If line 2 is less than line 1, enter the additional TAX OWED . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

See instructions for depositing requirements .

I declare this form is correct and complete to the best of my knowledge and belief. I know I owe the tax listed on this form, and I give

up my right to contest any court order requiring me to pay this amount.

Your signature

Date

Daytime phone

Paid preparer’s signature

PTIN

Date

Daytime phone

By Feb . 28, mail Form ETA and copies of 1099-MISC forms to: Minnesota Revenue, Mail Station 6525, St . Paul, MN 55146-6525

Phone: 651-282-9999 or 1-800-657-3594 (TTY: Call 711 for Minnesota Relay) . Email: withholding .tax@state .mn .us

(Rev . 11/13)

1

1 2

2