Form D-407 Nc K-1 - Beneficiary'S Share Of North Carolina Income, Adjustments, And Credits - 2014

ADVERTISEMENT

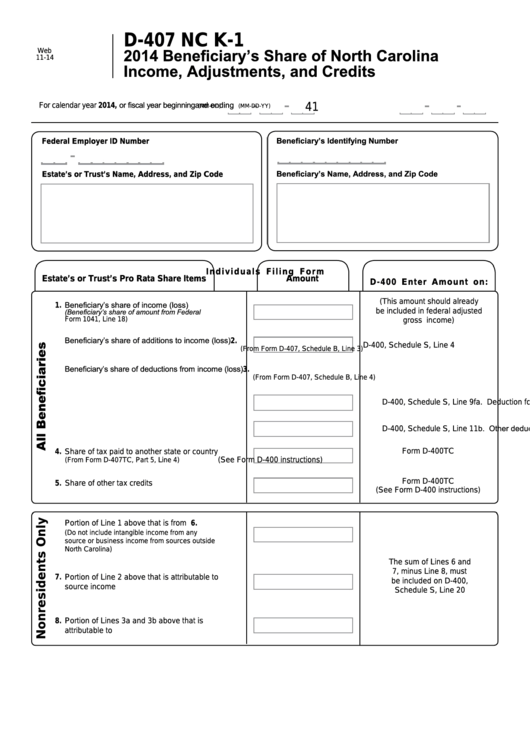

D-407 NC K-1

2014 Beneficiary’s Share of North Carolina

Web

11-14

Income, Adjustments, and Credits

For calendar year 2014, or fiscal year beginning

and ending

1

4

(MM-DD-YY)

(MM-DD)

Beneficiary’s Identifying Number

Federal Employer ID Number

Beneficiary’s Name, Address, and Zip Code

Estate’s or Trust’s Name, Address, and Zip Code

I n d i v i d u a l s F i l i n g F o r m

Estate’s or Trust’s Pro Rata Share Items

Amount

D-400 Enter Amount on:

(This amount should already

Beneficiary’s share of income (loss)

1.

(Beneficiary’s share of amount from Federal

be included in federal adjusted

Form 1041, Line 18)

gross income)

Beneficiary’s share of additions to income (loss)

2.

D-400, Schedule S, Line 4

(From Form D-407, Schedule B, Line 3)

Beneficiary’s share of deductions from income (loss)

3.

(From Form D-407, Schedule B, Line 4)

a. Deduction for bonus depreciation

D-400, Schedule S, Line 9f

b. Other deductions from income (loss)

D-400, Schedule S, Line 11

Form D-400TC

4.

Share of tax paid to another state or country

(See Form D-400 instructions)

(From Form D-407TC, Part 5, Line 4)

Form D-400TC

5. Share of other tax credits

(See Form D-400 instructions)

6.

Portion of Line 1 above that is from N.C. sources

(Do not include intangible income from any

source or business income from sources outside

North Carolina)

The sum of Lines 6 and

7, minus Line 8, must

7.

Portion of Line 2 above that is attributable to N.C.

be included on D-400,

source income

Schedule S, Line 20

8.

Portion of Lines 3a and 3b above that is

attributable to N.C.source income

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1