Rev. 10/02

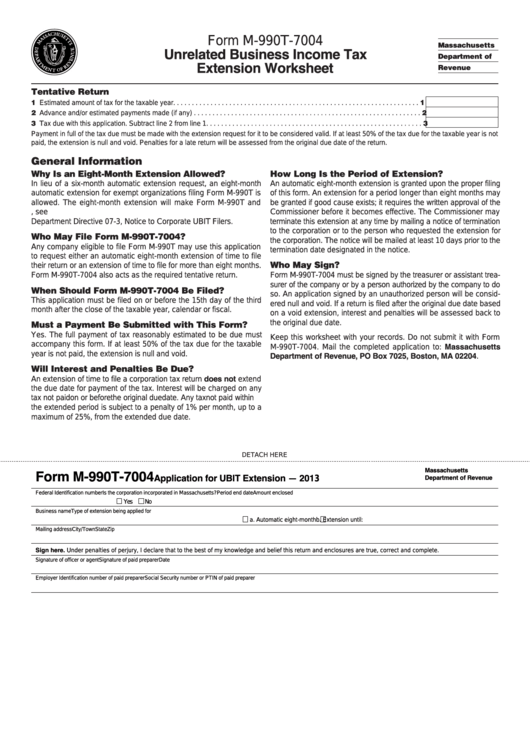

Form M-990T-7004

Massachusetts

Unrelated Business Income Tax

Department of

Extension Worksheet

Revenue

Tentative Return

1 Estimated amount of tax for the taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Advance and/or estimated payments made (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Tax due with this application. Subtract line 2 from line 1. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

Payment in full of the tax due must be made with the extension request for it to be considered valid. If at least 50% of the tax due for the taxable year is not

paid, the extension is null and void. Penalties for a late return will be assessed from the original due date of the return.

General Information

Why Is an Eight-Month Extension Allowed?

How Long Is the Period of Extension?

In lieu of a six-month automatic extension request, an eight-month

An automatic eight-month extension is granted upon the proper filing

automatic extension for exempt organizations filing Form M-990T is

of this form. An extension for a period longer than eight months may

allowed. The eight-month extension will make Form M-990T and

be granted if good cause exists; it requires the written approval of the

U.S. Form 990-T due on the same date. For further information, see

Commissioner before it becomes effective. The Commissioner may

Department Directive 07-3, Notice to Corporate UBIT Filers.

terminate this extension at any time by mailing a notice of termination

to the corporation or to the person who requested the extension for

Who May File Form M-990T-7004?

the corporation. The notice will be mailed at least 10 days prior to the

Any company eligible to file Form M-990T may use this application

termination date designated in the notice.

to request either an automatic eight-month extension of time to file

Who May Sign?

their return or an extension of time to file for more than eight months.

Form M-990T-7004 also acts as the required tentative return.

Form M-990T-7004 must be signed by the treasurer or assistant trea-

surer of the company or by a person authorized by the company to do

When Should Form M-990T-7004 Be Filed?

so. An application signed by an unauthorized person will be consid-

This application must be filed on or before the 15th day of the third

ered null and void. If a return is filed after the original due date based

month after the close of the taxable year, calendar or fiscal.

on a void extension, interest and penalties will be assessed back to

the original due date.

Must a Payment Be Submitted with This Form?

Yes. The full payment of tax reasonably estimated to be due must

Keep this worksheet with your records. Do not submit it with Form

accompany this form. If at least 50% of the tax due for the taxable

M-990T-7004. Mail the completed application to: Massachusetts

year is not paid, the extension is null and void.

Department of Revenue, PO Box 7025, Boston, MA 02204.

Will Interest and Penalties Be Due?

An extension of time to file a corporation tax return does not extend

the due date for payment of the tax. Interest will be charged on any

tax not paid on or before the original due date. Any tax not paid within

the extended period is subject to a penalty of 1% per month, up to a

maximum of 25%, from the extended due date.

DETACH HERE

Massachusetts

Form M-990T-7004

Application for UBIT Extension — 2013

Department of Revenue

Federal Identification number

Is the corporation incorporated in Massachusetts?

Period end date

Amount enclosed

Yes

No

Business name

Type of extension being applied for

a. Automatic eight-month

b. Extension until:

Mailing address

City/Town

State

Zip

Sign here. Under penalties of perjury, I declare that to the best of my knowledge and belief this return and enclosures are true, correct and complete.

Signature of officer or agent

Signature of paid preparer

Date

Employer Identification number of paid preparer

Social Security number or PTIN of paid preparer

1

1