Form D-403 Nc K-1 - Partner'S Share Of North Carolina Income, Adjustments, And Credits - 2014

ADVERTISEMENT

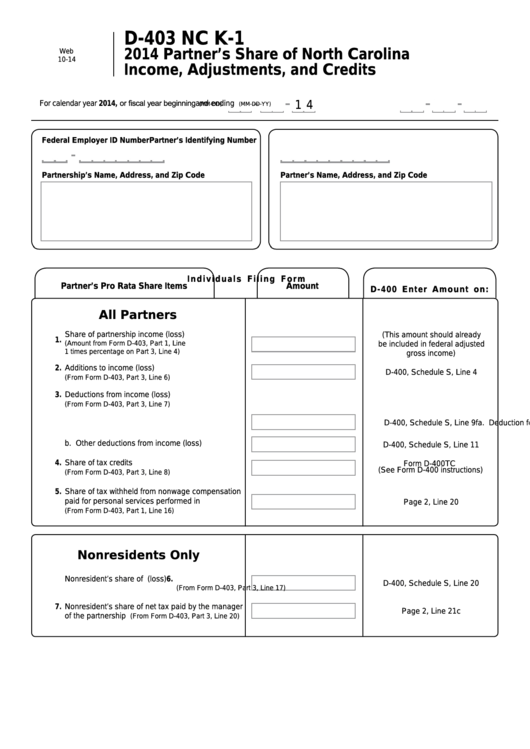

D-403 NC K-1

2014 Partner’s Share of North Carolina

Web

10-14

Income, Adjustments, and Credits

For calendar year 2014, or fiscal year beginning

1 4

and ending

(MM-DD)

(MM-DD-YY)

Federal Employer ID Number

Partner’s Identifying Number

Partnership’s Name, Address, and Zip Code

Partner’s Name, Address, and Zip Code

I n d i v i d u a l s F i l i n g F o r m

Partner’s Pro Rata Share Items

Amount

D-400 Enter Amount on:

All Partners

Share of partnership income (loss)

(This amount should already

1.

(Amount from Form D-403, Part 1, Line

be included in federal adjusted

1 times percentage on Part 3, Line 4)

gross income)

2. Additions to income (loss)

D-400, Schedule S, Line 4

(From Form D-403, Part 3, Line 6)

3. Deductions from income (loss)

(From Form D-403, Part 3, Line 7)

a. Deduction for bonus depreciation

D-400, Schedule S, Line 9f

b. Other deductions from income (loss)

D-400, Schedule S, Line 11

4. Share of tax credits

Form D-400TC

(See Form D-400 instructions)

(From Form D-403, Part 3, Line 8)

5. Share of tax withheld from nonwage compensation

paid for personal services performed in N.C.

Page 2, Line 20

(From Form D-403, Part 1, Line 16)

Nonresidents Only

6.

Nonresident’s share of N.C. taxable income (loss)

D-400, Schedule S, Line 20

(From Form D-403, Part 3, Line 17)

7.

Nonresident’s share of net tax paid by the manager

Page 2, Line 21c

of the partnership

(From Form D-403, Part 3, Line 20)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1