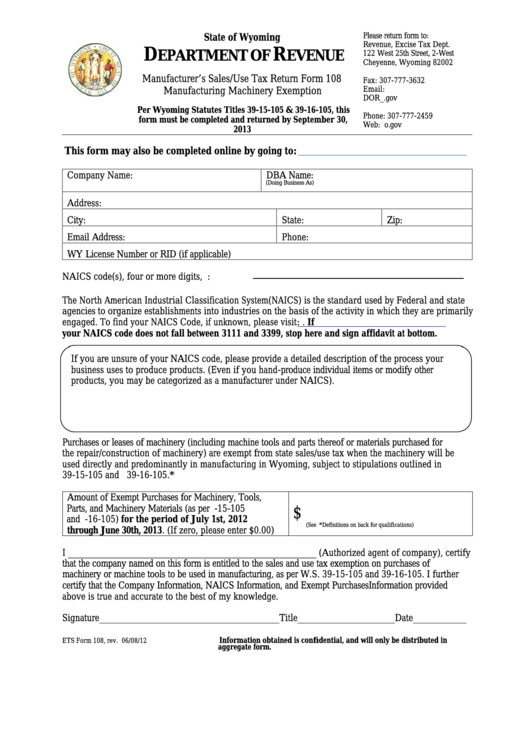

Form 108 - Manufacturer'S Sales/use Tax Return

ADVERTISEMENT

Please return form to:

State of Wyoming

Revenue, Excise Tax Dept.

D

R

EPARTMENT OF

EVENUE

122 West 25th Street, 2-West

Cheyenne, Wyoming 82002

Manufacturer’s Sales/Use Tax Return Form 108

Fax: 307-777-3632

Email:

Manufacturing Machinery Exemption

DOR_taxability@wyo.gov

Per Wyoming Statutes Titles 39-15-105 & 39-16-105, this

Phone: 307-777-2459

form must be completed and returned by September 30,

Web:

2013

This form may also be completed online by going to:

https://

Company Name:

DBA Name:

(Doing Business As)

Address:

City:

State:

Zip:

Email Address:

Phone:

WY License Number or RID (if applicable)

NAICS code(s), four or more digits, i.e. 3112 :

The North American Industrial Classification System (NAICS) is the standard used by Federal and state

agencies to organize establishments into industries on the basis of the activity in which they are primarily

engaged. To find your NAICS Code, if unknown, please visit: If

your NAICS code does not fall between 3111 and 3399, stop here and sign affidavit at bottom.

If you are unsure of your NAICS code, please provide a detailed description of the process your

business uses to produce products. (Even if you hand-produce individual items or modify other

products, you may be categorized as a manufacturer under NAICS).

Purchases or leases of machinery (including machine tools and parts thereof or materials purchased for

the repair/construction of machinery) are exempt from state sales/use tax when the machinery will be

used directly and predominantly in manufacturing in Wyoming, subject to stipulations outlined in W.S.

39-15-105 and W.S. 39-16-105.*

Amount of Exempt Purchases for Machinery, Tools,

Parts, and Machinery Materials (as per W.S. 39-15-105

$

and W.S. 39-16-105) for the period of July 1st, 2012

(See *Definitions on back for qualifications)

through June 30th, 2013. (If zero, please enter $0.00)

I ___________________________________________________ (Authorized agent of company), certify

that the company named on this form is entitled to the sales and use tax exemption on purchases of

machinery or machine tools to be used in manufacturing, as per W.S. 39-15-105 and 39-16-105. I further

certify that the Company Information, NAICS Information, and Exempt Purchases Information provided

above is true and accurate to the best of my knowledge.

Signature_____________________________________Title____________________Date___________

Information obtained is confidential, and will only be distributed in

ETS Form 108, rev. 06/08/12

aggregate form.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2