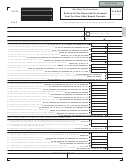

Form Ft-945/1045 - Sales Tax Prepayment On Motor Fuel/diesel Motor Fuel Return Page 2

ADVERTISEMENT

Page 2 of 2 FT-945/1045 (11/15)

Sales tax vendor identification number

Part 3 – Inventory reconciliation of motor fuel (in gallons) – sellers of motor fuel other than registered distributors only

26 Opening inventory of motor fuel ............................................................................................................................ 26

Adjustments to motor fuel inventory

27 Purchased in-state ............................................................................................ 27

28 Other gain (or loss) to inventory ....................................................................... 28

29 Net adjustments to inventory

............................... 29

(add lines 27 and 28; if line 28 is a loss, subtract line 28 from line 27)

30 Motor fuel available for sale

.................................................................................................... 30

(add lines 26 and 29)

31 Motor fuel sold, used, or transferred ..................................................................................................................... 31

32 Closing inventory .................................................................................................................................................. 32

Part 4 – Supplemental information – sellers of motor fuel other than registered distributors only

If you are not a registered distributor of motor fuel (Article 12-A), mark an X here

and see instructions for attachments required.

Do not include the sales tax prepayment reported on this return in any other sales tax return, schedule, or report.

Signature of authorized person

Official title

Authorized

E-mail address of authorized person

Telephone number

Date

person

(

)

Firm’s EIN

Preparer’s PTIN or SSN

Firm’s name

(or yours if self-employed)

Paid

preparer

Signature of individual preparing this return

Address

City

State

ZIP code

use

only

E-mail address of individual preparing this return

Telephone number

Preparer’s NYTPRIN

NYTPRIN

Date

(see instr.)

(

)

excl. code

Motor fuel regional tax adjustment worksheet

A –

B –

C –

D –

Number of gallons transferred

Differential rate

Adjustment

Net Adjustment

(column A column B)

×

Region 1 to Region 2

$.035 =

×

Region 3 to Region 1

$.015 =

×

Region 3 to Region 2

$.050 =

Subtotal 1

...................................................................................................................................

(total due; add the column C amounts)

×

Region 1 to Region 3

$.015 =

×

Region 2 to Region 1

$.035 =

×

Region 2 to Region 3

$.050 =

Subtotal 2

......................................................................................................................

(total overpayment; add the column C amounts)

Motor fuel regional tax adjustment total

.....................................................

(subtract subtotal 2 from subtotal 1; enter on line 10)

Web File your return at

44500211150094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2