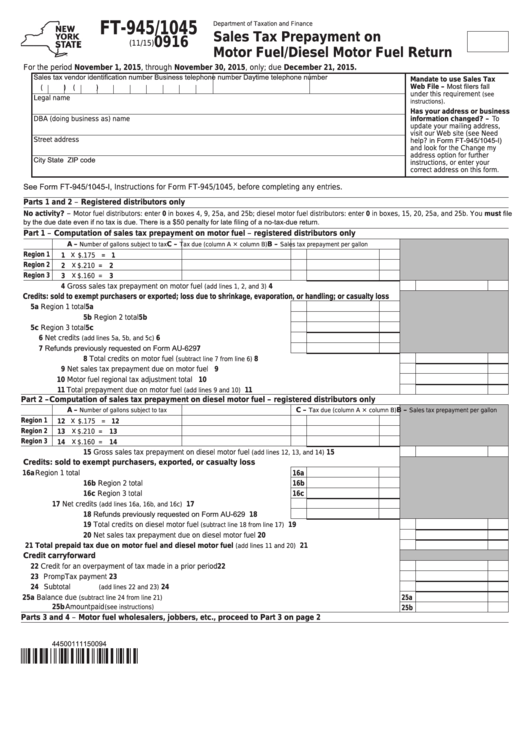

Form Ft-945/1045 - Sales Tax Prepayment On Motor Fuel/diesel Motor Fuel Return

ADVERTISEMENT

FT-945/1045

Department of Taxation and Finance

Sales Tax Prepayment on

0916

(11/15)

Motor Fuel/Diesel Motor Fuel Return

For the period November 1, 2015, through November 30, 2015, only; due December 21, 2015.

Sales tax vendor identification number

Business telephone number

Daytime telephone number

Mandate to use Sales Tax

Web File – Most filers fall

(

)

(

)

under this requirement

(see

Legal name

.

instructions)

Has your address or business

DBA (doing business as) name

information changed? – To

update your mailing address,

visit our Web site (see Need

help? in Form FT-945/1045-I)

Street address

and look for the Change my

address option for further

City

State

ZIP code

instructions, or enter your

correct address on this form.

See Form FT-945/1045-I, Instructions for Form FT-945/1045, before completing any entries.

Parts 1 and 2 – Registered distributors only

Motor fuel distributors: enter 0 in boxes 4, 9, 25a, and 25b; diesel motor fuel distributors: enter 0 in boxes, 15, 20, 25a, and 25b. You must file

No activity?

–

by the due date even if no tax is due. There is a $50 penalty for late filing of a no-tax-due return.

Part 1 – Computation of sales tax prepayment on motor fuel – registered distributors only

Tax due (column A column B)

A –

B –

C –

Number of gallons subject to tax

Sales tax prepayment per gallon

Region 1

×

1

$.175 =

1

Region 2

×

2

$.210 =

2

×

Region 3

3

$.160 =

3

4 Gross sales tax prepayment on motor fuel

............................................................

4

(add lines 1, 2, and 3)

Credits: sold to exempt purchasers or exported; loss due to shrinkage, evaporation, or handling; or casualty loss

5a Region 1 total ...................................................................................

5a

5b Region 2 total ...................................................................................

5b

5c Region 3 total ..................................................................................

5c

6 Net credits

..................................................

6

(add lines 5a, 5b, and 5c)

7 Refunds previously requested on Form AU-629 ..............................

7

8 Total credits on motor fuel (

...............................................................................

8

subtract line 7 from line 6)

9 Net sales tax prepayment due on motor fuel .........................................................................................

9

10 Motor fuel regional tax adjustment total ................................................................................................ 10

11 Total prepayment due on motor fuel

..........................................................................

11

(add lines 9 and 10)

Part 2 – Computation of sales tax prepayment on diesel motor fuel – registered distributors only

Tax due (column A column B)

A –

B –

C –

Number of gallons subject to tax

Sales tax prepayment per gallon

×

Region 1

12

$.175 =

12

Region 2

×

13

$.210 =

13

×

Region 3

14

$.160 =

14

15 Gross sales tax prepayment on diesel motor fuel

.............................................

15

(add lines 12, 13, and 14)

Credits: sold to exempt purchasers, exported, or casualty loss

16a Region 1 total ................................................................................... 16a

16b Region 2 total ................................................................................... 16b

16c Region 3 total ................................................................................... 16c

17 Net credits

..............................................

17

(add lines 16a, 16b, and 16c)

18 Refunds previously requested on Form AU-629 ..............................

18

19 Total credits on diesel motor fuel

................................................................. 19

(subtract line 18 from line 17)

20 Net sales tax prepayment due on diesel motor fuel .............................................................................. 20

21 Total prepaid tax due on motor fuel and diesel motor fuel

...............................

21

(add lines 11 and 20)

Credit carryforward

22 Credit for an overpayment of tax made in a prior period ........................................................................ 22

23 PrompTax payment ................................................................................................................................ 23

24 Subtotal

.................................................................................................................. 24

(add lines 22 and 23)

25a Balance due

................................................................................................. 25a

(subtract line 24 from line 21)

25b Amount paid

.................................................................................................................. 25b

(see instructions)

Parts 3 and 4 – Motor fuel wholesalers, jobbers, etc., proceed to Part 3 on page 2

44500111150094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2