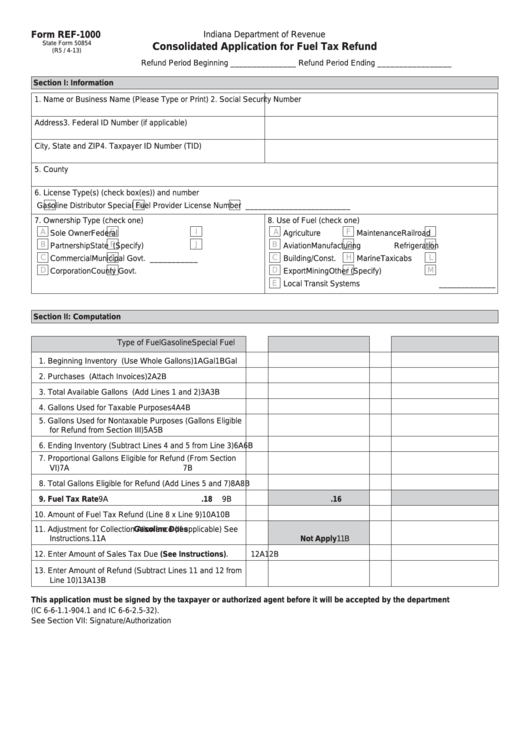

Form REF-1000

Indiana Department of Revenue

State Form 50854

Consolidated Application for Fuel Tax Refund

(R5 / 4-13)

Refund Period Beginning _______________ Refund Period Ending _________________

Section I: Information

1. Name or Business Name (Please Type or Print)

2. Social Security Number

Address

3. Federal ID Number (if applicable)

City, State and ZIP

4. Taxpayer ID Number (TID)

5. County

6. License Type(s) (check box(es)) and number

A

B

C

Gasoline Distributor

Special Fuel Provider

License Number ________________________

7. Ownership Type (check one)

8. Use of Fuel (check one)

A

E

I

A

F

J

Sole Owner

Federal Govt.

Public Schools

Agriculture

Maintenance

Railroad

B

F

J

B

G

K

Partnership

State Govt.

Other (Specify)

Aviation

Manufacturing

Refrigeration

C

G

C

H

L

Commercial

Municipal Govt.

___________

Building/Const.

Marine

Taxicabs

D

H

D

I

M

Corporation

County Govt.

Export

Mining

Other (Specify)

E

Local Transit Systems

_____________

Section II: Computation

Type of Fuel

Gasoline

Special Fuel

1. Beginning Inventory (Use Whole Gallons)

1A

Gal

1B

Gal

2. Purchases (Attach Invoices)

2A

2B

3. Total Available Gallons (Add Lines 1 and 2)

3A

3B

4. Gallons Used for Taxable Purposes

4A

4B

5. Gallons Used for Nontaxable Purposes (Gallons Eligible

for Refund from Section III)

5A

5B

6. Ending Inventory (Subtract Lines 4 and 5 from Line 3)

6A

6B

7. Proportional Gallons Eligible for Refund (From Section

VI)

7A

7B

8. Total Gallons Eligible for Refund (Add Lines 5 and 7)

8A

8B

9. Fuel Tax Rate

9A

.18

9B

.16

10. Amount of Fuel Tax Refund (Line 8 x Line 9)

10A

10B

11. Adjustment for Collection Allowance (If applicable) See

Gasoline Does

Instructions.

11A

Not Apply

11B

12. Enter Amount of Sales Tax Due (See Instructions).

12A

12B

13. Enter Amount of Refund (Subtract Lines 11 and 12 from

Line 10)

13A

13B

This application must be signed by the taxpayer or authorized agent before it will be accepted by the department

(IC 6-6-1.1-904.1 and IC 6-6-2.5-32).

See Section VII: Signature/Authorization

1

1 2

2 3

3 4

4 5

5 6

6