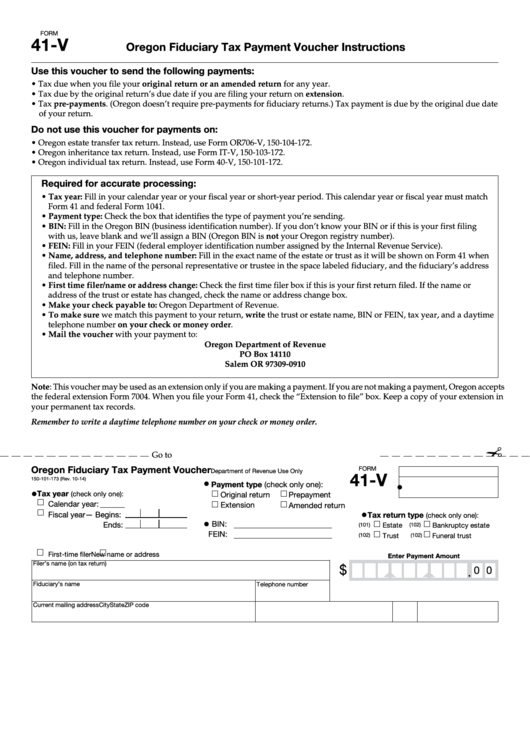

Form 41-V - Oregon Fiduciary Tax Payment Voucher Instructions

ADVERTISEMENT

FORM

41-V

Oregon Fiduciary Tax Payment Voucher Instructions

Use this voucher to send the following payments:

• Tax due when you file your original return or an amended return for any year.

• Tax due by the original return’s due date if you are filing your return on extension.

• Tax pre-payments. (Oregon doesn’t require pre-payments for fiduciary returns.) Tax payment is due by the original due date

of your return.

Do not use this voucher for payments on:

• Oregon estate transfer tax return. Instead, use Form OR706-V, 150-104-172.

• Oregon inheritance tax return. Instead, use Form IT-V, 150-103-172.

• Oregon individual tax return. Instead, use Form 40-V, 150-101-172.

Required for accurate processing:

• Tax year: Fill in your calendar year or your fiscal year or short-year period. This calendar year or fiscal year must match

Form 41 and federal Form 1041.

• Payment type: Check the box that identifies the type of payment you’re sending.

• BIN: Fill in the Oregon BIN (business identification number). If you don’t know your BIN or if this is your first filing

with us, leave blank and we’ll assign a BIN (Oregon BIN is not your Oregon registry number).

• FEIN: Fill in your FEIN (federal employer identification number assigned by the Internal Revenue Service).

• Name, address, and telephone number: Fill in the exact name of the estate or trust as it will be shown on Form 41 when

filed. Fill in the name of the personal representative or trustee in the space labeled fiduciary, and the fiduciary’s address

and telephone number.

• First time filer/name or address change: Check the first time filer box if this is your first return filed. If the name or

address of the trust or estate has changed, check the name or address change box.

• Make your check payable to: Oregon Department of Revenue.

• To make sure we match this payment to your return, write the trust or estate name, BIN or FEIN, tax year, and a daytime

telephone number on your check or money order.

• Mail the voucher with your payment to:

Oregon Department of Revenue

PO Box 14110

Salem OR 97309-0910

Note: This voucher may be used as an extension only if you are making a payment. If you are not making a payment, Oregon accepts

the federal extension Form 7004. When you file your Form 41, check the “Extension to file” box. Keep a copy of your extension in

your permanent tax records.

Remember to write a daytime telephone number on your check or money order.

Clear Form

✁

Go to to print more vouchers.

Oregon Fiduciary Tax Payment Voucher

FORM

Department of Revenue Use Only

41-V

150-101-173 (Rev. 10-14)

•

Payment type (check only one):

•

•

Tax year

(check only one):

Original return

Prepayment

Calendar year:

Extension

Amended return

•

Fiscal year— Begins:

Tax return type

(check only one):

•

BIN:

Ends:

Estate

Bankruptcy estate

(101)

(102)

FEIN:

Trust

Funeral trust

(102)

(102)

First-time filer

New name or address

Enter Payment Amount

Filer’s name (on tax return)

$

0 0

.

Fiduciary’s name

Telephone number

Current mailing address

City

State

ZIP code

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1