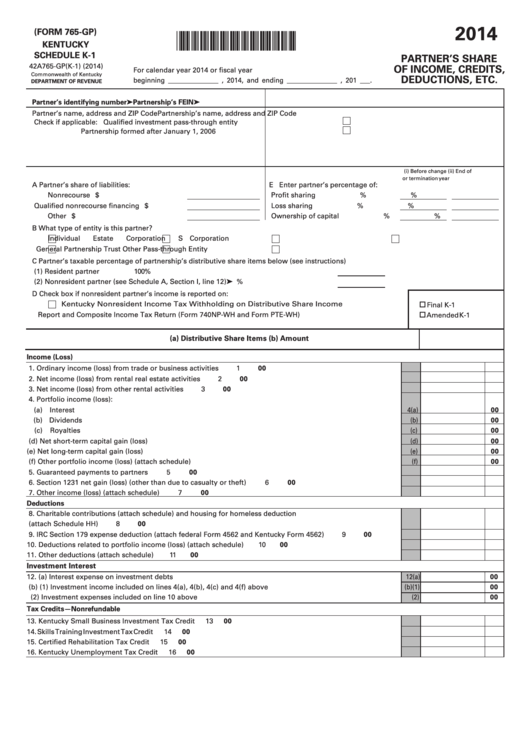

Schedule K-1 (Form 765-Gp) - Partner'S Share Of Income, Credits, Deductions, Etc. - 2014

ADVERTISEMENT

2014

(FORM 765-GP)

*1400010036*

KENTUCKY

SCHEDULE K-1

PARTNER’S SHARE

42A765-GP(K-1) (2014)

OF INCOME, CREDITS,

For calendar year 2014 or fiscal year

Commonwealth of Kentucky

DEDUCTIONS, ETC.

beginning _______________ , 2014, and ending _______________ , 201 ___.

DEPARTMENT OF REVENUE

Partner’s identifying number ➤

Partnership’s FEIN ➤

Partner’s name, address and ZIP Code

Partnership’s name, address and ZIP Code

Check if applicable:

Qualified investment pass-through entity

Partnership formed after January 1, 2006

(i) Before change

(ii) End of

or termination

year

A

Partner’s share of liabilities:

E Enter partner’s percentage of:

Nonrecourse ......................................... $

Profit sharing ...................................

%

%

Qualified nonrecourse financing ......... $

Loss sharing .....................................

%

%

Other ...................................................... $

Ownership of capital .......................

%

%

B

What type of entity is this partner?

Individual

Estate

Corporation

S Corporation

General Partnership

Trust

Other Pass-through Entity

C

Partner’s taxable percentage of partnership’s distributive share items below (see instructions)

(1) Resident partner .................................................................................................................

100%

(2) Nonresident partner (see Schedule A, Section I, line 12) .............................................➤

%

D

Check box if nonresident partner’s income is reported on:

Kentucky Nonresident Income Tax Withholding on Distributive Share Income

Final K-1

Report and Composite Income Tax Return (Form 740NP-WH and Form PTE-WH)

Amended K-1

(a) Distributive Share Items

(b) Amount

Income (Loss)

1.

Ordinary income (loss) from trade or business activities ........................................................................................

1

00

2.

Net income (loss) from rental real estate activities ..................................................................................................

2

00

3.

Net income (loss) from other rental activities ..........................................................................................................

3

00

4.

Portfolio income (loss):

(a) Interest ................................................................................................................................................................

4(a)

00

(b) Dividends ............................................................................................................................................................

(b)

00

(c)

Royalties .............................................................................................................................................................

(c)

00

(d) Net short-term capital gain (loss) .....................................................................................................................

(d)

00

(e) Net long-term capital gain (loss).......................................................................................................................

(e)

00

(f)

Other portfolio income (loss) (attach schedule) ...............................................................................................

(f)

00

5.

Guaranteed payments to partners ............................................................................................................................

5

00

6.

Section 1231 net gain (loss) (other than due to casualty or theft) .........................................................................

6

00

7.

Other income (loss) (attach schedule) ......................................................................................................................

7

00

Deductions

8.

Charitable contributions (attach schedule) and housing for homeless deduction

(attach Schedule HH) ...................................................................................................................................................

8

00

9.

IRC Section 179 expense deduction (attach federal Form 4562 and Kentucky Form 4562) ..................................

9

00

10.

Deductions related to portfolio income (loss) (attach schedule) .............................................................................

10

00

11.

Other deductions (attach schedule) ...........................................................................................................................

11

00

Investment Interest

12.

(a) Interest expense on investment debts ..............................................................................................................

12(a)

00

(b) (1) Investment income included on lines 4(a), 4(b), 4(c) and 4(f) above .......................................................

(b)(1)

00

(2) Investment expenses included on line 10 above .......................................................................................

(2)

00

Tax Credits—Nonrefundable

13.

Kentucky Small Business Investment Tax Credit ......................................................................................................

13

00

14.

Skills Training Investment Tax Credit ..........................................................................................................................

14

00

15.

Certified Rehabilitation Tax Credit ..............................................................................................................................

15

00

16.

Kentucky Unemployment Tax Credit ..........................................................................................................................

16

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4