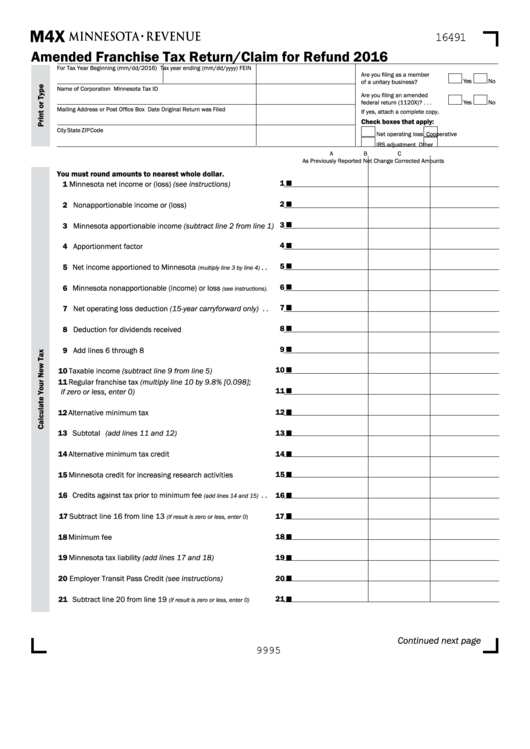

M4X

16491

Amended Franchise Tax Return/Claim for Refund 2016

For Tax Year Beginning (mm/dd/2016)

Tax year ending (mm/dd/yyyy)

FEIN

Are you filing as a member

Yes

No

of a unitary business? . . . .

Name of Corporation

Minnesota Tax ID

Are you filing an amended

Yes

No

federal return (1120X)? . . .

Mailing Address or Post Office Box

Date Original Return was Filed

If yes, attach a complete copy .

Check boxes that apply:

City

State

ZIP Code

Net operating loss

Cooperative

IRS adjustment

Other

A

B

C

As Previously Reported

Net Change

Corrected Amounts

You must round amounts to nearest whole dollar.

1

1 Minnesota net income or (loss) (see instructions) . . . . . . . .

2

2 Nonapportionable income or (loss) . . . . . . . . . . . . . . . . . . . .

3

3 Minnesota apportionable income (subtract line 2 from line 1)

4

4 Apportionment factor . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

5 Net income apportioned to Minnesota

. .

(multiply line 3 by line 4)

6

6 Minnesota nonapportionable (income) or loss

(see instructions).

7

7 Net operating loss deduction (15-year carryforward only) . .

8

8 Deduction for dividends received . . . . . . . . . . . . . . . . . . . . . .

9

9 Add lines 6 through 8 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10

10 Taxable income (subtract line 9 from line 5) . . . . . . . . . . . . .

11 Regular franchise tax (multiply line 10 by 9.8% [0.098];

11

if zero or less, enter 0) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12 Alternative minimum tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12

13

13 Subtotal (add lines 11 and 12) . . . . . . . . . . . . . . . . . . . . . . . .

14 Alternative minimum tax credit . . . . . . . . . . . . . . . . . . . . . . . .

14

15

15 Minnesota credit for increasing research activities . . . . . . . .

16 Credits against tax prior to minimum fee

. .

16

(add lines 14 and 15)

17

17 Subtract line 16 from line 13

. . . .

(if result is zero or less, enter 0)

18 Minimum fee . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18

19

19 Minnesota tax liability (add lines 17 and 18) . . . . . . . . . . . . .

20 Employer Transit Pass Credit (see instructions) . . . . . . . . . . .

20

21

21 Subtract line 20 from line 19

. . . . .

(if result is zero or less, enter 0)

Continued next page

9995

1

1 2

2 3

3 4

4 5

5 6

6 7

7