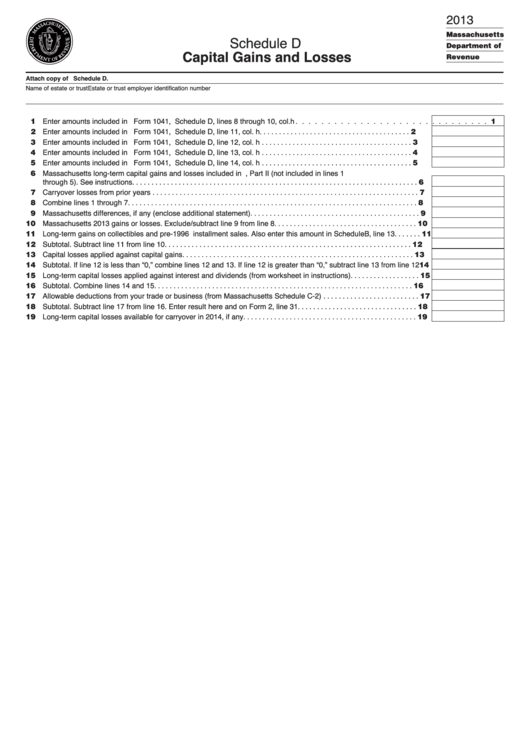

2013

Schedule D

Capital Gains and Losses

Massachusetts

epartment of

Revenue

Attach copy of U.S. Schedule D.

Name of estate or trust

Estate or trust employer identification number

11 Enter amounts included in U.S. Form 1041, Schedule D, lines 8 through 10, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

12 Enter amounts included in U.S. Form 1041, Schedule D, line 11, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

13 Enter amounts included in U.S. Form 1041, Schedule D, line 12, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

14 Enter amounts included in U.S. Form 1041, Schedule D, line 13, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

15 Enter amounts included in U.S. Form 1041, Schedule D, line 14, col. h . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

16 Massachusetts long-term capital gains and losses included in U.S. Form 4797, Part II (not included in lines 1

through 5). See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

17 Carryover losses from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

18 Combine lines 1 through 7. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

19 Massachusetts differences, if any (enclose additional statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Massachusetts 2013 gains or losses. Exclude/subtract line 9 from line 8. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Long-term gains on collectibles and pre-1996 installment sales. Also enter this amount in Schedule B, line 13 . . . . . . . 11

12 Subtotal. Subtract line 11 from line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Capital losses applied against capital gains . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Subtotal. If line 12 is less than “0,” combine lines 12 and 13. If line 12 is greater than “0,” subtract line 13 from line 12 14

15 Long-term capital losses applied against interest and dividends (from worksheet in instructions) . . . . . . . . . . . . . . . . . . 15

16 Subtotal. Combine lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Allowable deductions from your trade or business (from Massachusetts Schedule C-2) . . . . . . . . . . . . . . . . . . . . . . . . . 17

18 Subtotal. Subtract line 17 from line 16. Enter result here and on Form 2, line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

19 Long-term capital losses available for carryover in 2014, if any. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

1

1