Clear

Print

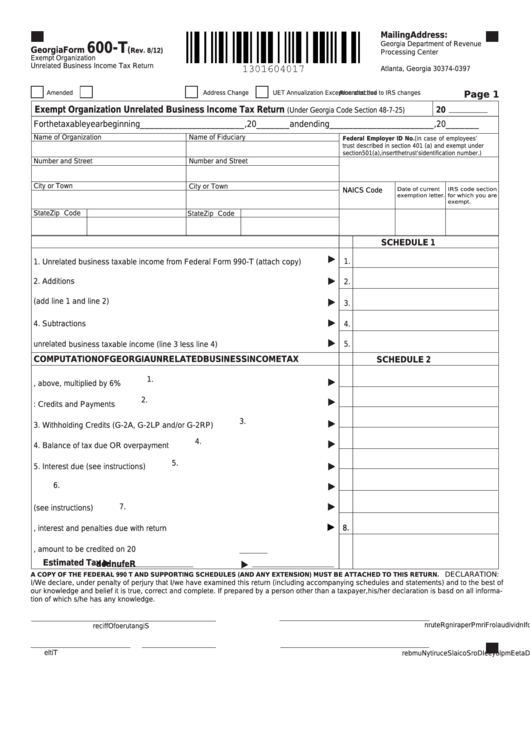

MailingAddress:

Georgia Department of Revenue

600-T

Rev. 8/12)

Georgia Form

(

Processing Center

Exempt Organization

P.O. Box 740397

Unrelated Business Income Tax Return

Atlanta, Georgia 30374-0397

Page 1

Amended due to IRS changes

Address Change

Amended

UET Annualization Exception attached

Exempt Organization Unrelated Business Income Tax Return

2 0

(Under Georgia Code Section 48-7-25)

For the taxable year beginning ______________________, 20_______ and ending ______________________ , 20_______

Name of Organization

Name of Fiduciary

Federal Employer ID No. (in case of employees’

trust described in section 401 (a) and exempt under

section 501 (a), insert the trust’s identification number.)

Number and Street

Number and Street

City or Town

City or Town

Date of current

IRS code section

NAICS Code

exemption letter.

for which you are

exempt.

State

Zip Code

State

Zip Code

SCHEDULE 1

1.

1. Unrelated business taxable income from Federal Form 990-T (attach copy).........

2. Additions ...............................................................................................................

2.

3. Total (add line 1 and line 2) ................................................................................

3.

4. Subtractions ........................................................................................................

4.

5. Georgia unrelated business taxable income (line 3 less line 4) ............................

5.

COMPUTATION OF GEORGIA UNRELATED BUSINESS INCOME TAX

SCHEDULE 2

1.

1. Line 5, above, multiplied by 6% ...........................................................................

2.

2. Less: Credits and Payments .................................................................................

3.

3. Withholding Credits (G-2A, G-2LP and/or G-2RP) ...............................................

4.

4. Balance of tax due OR overpayment ....................................................................

5.

5. Interest due (see instructions) ..............................................................................

6.

6. Underestimated tax penalty ...................................................................................

7.

7. Other penalties due (see instructions) ..................................................................

8. Balance of tax, interest and penalties due with return ...........................................

8.

9. If line 4 is an overpayment, amount to be credited on 20

Estimated Ta

x

R

e

u f

n

d

e

d

DECLARATION:

A COPY OF THE FEDERAL 990 T AND SUPPORTING SCHEDULES (AND ANY EXTENSION) MUST BE ATTACHED TO THIS RETURN.

I/We declare, under penalty of perjury that I/we have examined this return (including accompanying schedules and statements) and to the best of

our knowledge and belief it is true, correct and complete. If prepared by a person other than a taxpayer,his/her declaration is basd on all informa-

tion of which s/he has any knowledge.

S

g i

n

a

u t

e r

f o

n I

d

v i

d i

u

l a

r o

F

r i

m

P

e r

p

r a

n i

g

R

e

u t

n r

S

g i

n

a

u t

e r

f o

O

f

c i f

r e

T

t i

e l

D

a

e t

E

m

p

o l

y

e

e

D I

r o

S

o

c

l a i

S

e

c

r u

y t i

N

u

m

b

r e

1

1 2

2