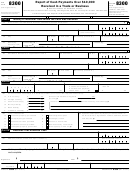

8300

8300

Report of Cash Payments Over $10,000

IRS

FinCEN

Form

Received in a Trade or Business

Form

(Rev. July 2012)

(Rev. July 2012)

See instructions for definition of cash.

▶

OMB No. 1506-0018

OMB No. 1545-0892

Use this form for transactions occurring after July 8, 2012. Do not use prior versions after this date.

▶

Department of the Treasury

Department of the Treasury

Financial Crimes

For Privacy Act and Paperwork Reduction Act Notice, see the last page.

Internal Revenue Service

Enforcement Network

1

Check appropriate box(es) if:

a

b

Amends prior report;

Suspicious transaction.

Part I

Identity of Individual From Whom the Cash Was Received

2

If more than one individual is involved, check here and see instructions .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

▶

3

Last name

4 First name

5 M.I.

6 Taxpayer identification number

8 Date of birth .

7

.

.

Address (number, street, and apt. or suite no.)

M

M

D

D

Y

Y

Y

Y

▶

(see instructions)

9

City

10 State

11 ZIP code

12 Country (if not U.S.)

13 Occupation, profession, or business

14

Identifying

b Issued by

a Describe ID

▶

▶

document (ID)

c Number

▶

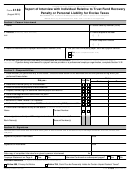

Part II

Person on Whose Behalf This Transaction Was Conducted

15

If this transaction was conducted on behalf of more than one person, check here and see instructions .

.

.

.

.

.

.

.

.

.

.

▶

16

Individual’s last name or organization’s name

17 First name

18 M.I.

19 Taxpayer identification number

20

Doing business as (DBA) name (see instructions)

Employer identification number

21

Address (number, street, and apt. or suite no.)

22 Occupation, profession, or business

23

24 State

25 ZIP code

26 Country (if not U.S.)

City

b Issued by

27

Alien

a Describe ID

▶

▶

identification (ID)

c Number

▶

Part III

Description of Transaction and Method of Payment

28

29 Total cash received

30

31 Total price if different from

Date cash received

If cash was received in

item 29

M

M

D

D

Y

Y

Y

Y

more than one payment,

$

.00

$

.00

check here

.

.

.

▶

32

Amount of cash received (in U.S. dollar equivalent) (must equal item 29) (see instructions):

$

(Amount in $100 bills or higher $

.00 )

a

U.S. currency

.00

$

)

(Country

b

Foreign currency

.00

▶

}

$

c

Cashier’s check(s)

.00

Issuer’s name(s) and serial number(s) of the monetary instrument(s)

▶

$

d

Money order(s)

.00

$

e

Bank draft(s)

.00

f

Traveler’s check(s)

$

.00

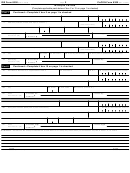

33

Type of transaction

34 Specific description of property or service shown in

a

f

Personal property purchased

Debt obligations paid

33. Give serial or registration number, address, docket

b

Real property purchased

g

Exchange of cash

number, etc.

▶

c

Personal services provided

h

Escrow or trust funds

d

i

Business services provided

Bail received by court clerks

e

Intangible property purchased

j

Other (specify in item 34)

▶

Part IV

Business That Received Cash

36 Employer identification number

35

Name of business that received cash

37

Address (number, street, and apt. or suite no.)

Social security number

38

39 State

40 ZIP code

41 Nature of your business

City

Under penalties of perjury, I declare that to the best of my knowledge the information I have furnished above is true, correct,

42

and complete.

Signature

Title

Authorized official

44 Type or print name of contact person

45 Contact telephone number

M

M

D

D

Y

Y

Y

Y

43 Date of

signature

8300

8300

IRS Form

(Rev. 7-2012)

FinCEN Form

(Rev. 7-2012)

Cat. No. 62133S

1

1 2

2 3

3 4

4 5

5