Form

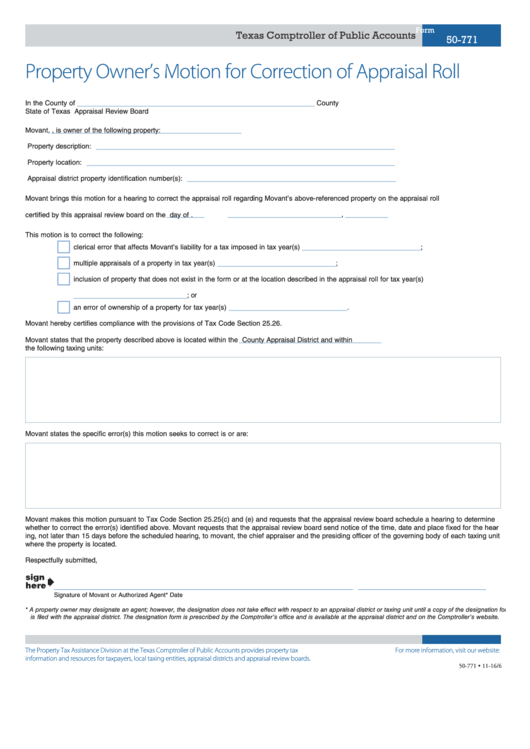

Texas Comptroller of Public Accounts

50-771

Property Owner’s Motion for Correction of Appraisal Roll

_________________________

_________________________

In the County of

County

State of Texas

Appraisal Review Board

________________________________________

Movant,

, is owner of the following property:

_______________________________________________________________

Property description:

_________________________________________________________________

Property location:

____________________________________________

Appraisal district property identification number(s):

Movant brings this motion for a hearing to correct the appraisal roll regarding Movant’s above-referenced property on the appraisal roll

________

________________________

_________

certified by this appraisal review board on the

day of

,

.

This motion is to correct the following:

_________________________

clerical error that affects Movant’s liability for a tax imposed in tax year(s)

;

_________________________

multiple appraisals of a property in tax year(s)

;

inclusion of property that does not exist in the form or at the location described in the appraisal roll for tax year(s)

________________________

; or

_________________________

an error of ownership of a property for tax year(s)

.

Movant hereby certifies compliance with the provisions of Tax Code Section 25.26.

______________________________

Movant states that the property described above is located within the

County Appraisal District and within

the following taxing units:

Movant states the specific error(s) this motion seeks to correct is or are:

Movant makes this motion pursuant to Tax Code Section 25.25(c) and (e) and requests that the appraisal review board schedule a hearing to determine

whether to correct the error(s) identified above. Movant requests that the appraisal review board send notice of the time, date and place fixed for the hear

-

ing, not later than 15 days before the scheduled hearing, to movant, the chief appraiser and the presiding officer of the governing body of each taxing unit

where the property is located.

Respectfully submitted,

_______________________________________________________________

___________________________

Signature of Movant or Authorized Agent*

Date

* A property owner may designate an agent; however, the designation does not take effect with respect to an appraisal district or taxing unit until a copy of the designation form

is filed with the appraisal district. The designation form is prescribed by the Comptroller’s office and is available at the appraisal district and on the Comptroller’s website.

The Property Tax Assistance Division at the Texas Comptroller of Public Accounts provides property tax

For more information, visit our website:

comptroller.texas.gov/taxes/property-tax

information and resources for taxpayers, local taxing entities, appraisal districts and appraisal review boards.

50-771 • 11-16/6

1

1 2

2