Penalty Waiver Request Form - Guadalupe Appraisal District

ADVERTISEMENT

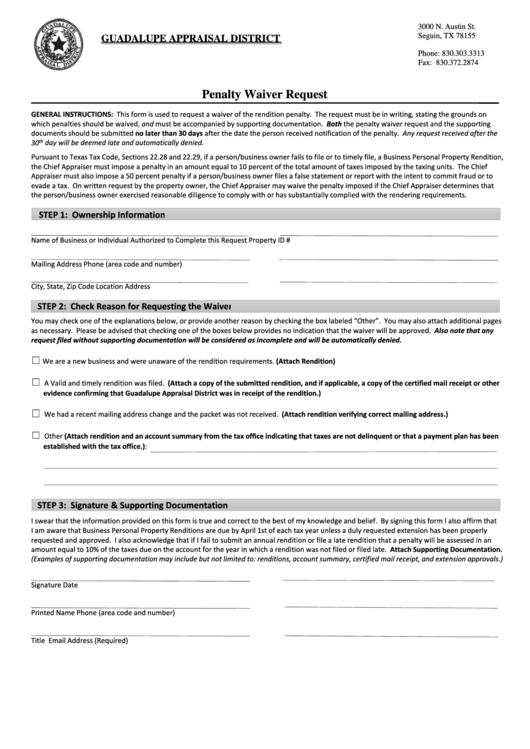

3000 N. Austin St.

Seguin, TX 78155

GUADALUPE APPRAISAL DISTRICT

Phone: 830.303.3313

Fax: 830.372.2874

Penalty Waiver Request

GENERAL INSTRUCTIONS: This form is used to request a waiver of the rendition penalty. The request must be in writing, stating the grounds on

which penalties should be waived, and must be accompanied by supporting documentation. Both the penalty waiver request and the supporting

documents should be submitted no later than 30 days after the date the person received notification of the penalty. Any request received after the

th

30

day will be deemed late and automatically denied.

Pursuant to Texas Tax Code, Sections 22.28 and 22.29, if a person/business owner fails to file or to timely file, a Business Personal Property Rendition,

the Chief Appraiser must impose a penalty in an amount equal to 10 percent of the total amount of taxes imposed by the taxing units. The Chief

Appraiser must also impose a 50 percent penalty if a person/business owner files a false statement or report with the intent to commit fraud or to

evade a tax. On written request by the property owner, the Chief Appraiser may waive the penalty imposed if the Chief Appraiser determines that

the person/business owner exercised reasonable diligence to comply with or has substantially complied with the rendering requirements.

STEP 1: Ownership Information

Name of Business or Individual Authorized to Complete this Request

Property ID #

Mailing Address

Phone (area code and number)

City, State, Zip Code

Location Address

STEP 2: Check Reason for Requesting the Waiver

You may check one of the explanations below, or provide another reason by checking the box labeled “Other”. You may also attach additional pages

as necessary. Please be advised that checking one of the boxes below provides no indication that the waiver will be approved. Also note that any

request filed without supporting documentation will be considered as incomplete and will be automatically denied.

☐

We are a new business and were unaware of the rendition requirements. (Attach Rendition)

☐

A Valid and timely rendition was filed. (Attach a copy of the submitted rendition, and if applicable, a copy of the certified mail receipt or other

evidence confirming that Guadalupe Appraisal District was in receipt of the rendition.)

☐

We had a recent mailing address change and the packet was not received. (Attach rendition verifying correct mailing address.)

☐

Other (Attach rendition and an account summary from the tax office indicating that taxes are not delinquent or that a payment plan has been

established with the tax office.):

STEP 3: Signature & Supporting Documentation

I swear that the information provided on this form is true and correct to the best of my knowledge and belief. By signing this form I also affirm that

I am aware that Business Personal Property Renditions are due by April 1st of each tax year unless a duly requested extension has been properly

requested and approved. I also acknowledge that if I fail to submit an annual rendition or file a late rendition that a penalty will be assessed in an

amount equal to 10% of the taxes due on the account for the year in which a rendition was not filed or filed late. Attach Supporting Documentation.

(Examples of supporting documentation may include but not limited to: renditions, account summary, certified mail receipt, and extension approvals.)

Signature

Date

Printed Name

Phone (area code and number)

Title

Email Address (Required)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1