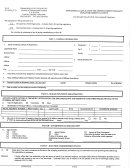

Form Esd-Ark-501 - Application For Unemployment Insurance Benefits Page 7

ADVERTISEMENT

Arkansas Division of Legislative Audit

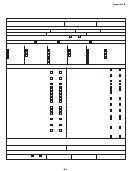

Exhibit V

interest rate of 4.1% in calendar year 2011.

DWS plans to repay the advances with

Arkansas Department of Workforce Services

interest by 2015. To date, DWS has made

Employer Contribution Rate Formula

one interest payment of $10.1 million and

one principal payment of $29.1 million,

Contributing

unemployment

insurance

leaving a loan balance of $330.9 million at

taxpayers report wages paid quarterly and

pay the Arkansas contribution rate on the

December 31, 2011. On April 1, 2011, Ar-

first $12,000 (increased from $10,000 on

kansas law increased the unemployment tax

January 1, 2010) of wages paid to each

rate on all contributing employers by 0.2% to

employee in each calendar year. The con-

fund the interest due on the advances. The

tribution rate is the sum of the following:

entire employer contribution rate formula is

discussed in Exhibit V on page 7.

The employer rate – Either (a) the new

employer rate of 2.9% for the first three

Based on our review of the federal funds

years of the employer’s existence or (b)

advanced from the federal government, we

the experienced employer rate for employ-

conclude the advances were allowed and, as

ers in existence for more than three years.

shown in DWS’ financial statements at

The experienced employer rate varies

Appendix

A,

were

necessary to

pay

from 0.1% to 10%, depending upon if and

unemployment benefits.

Of 27 states and

how

much

unemployment

insurance

the U.S. Virgin Islands, which owe a total of

benefits have been paid on behalf of the

$37.9 billion to the federal government,

employer.

Arkansas ranks 19th in terms of monies

The stabilization tax – An additional 0.8%

owed.

that is levied on all contributing employers

when the balance of the unemployment

CONCLUSION

insurance fund is insufficient to pay for

anticipated obligations.

As a result of our review, we did not identify

The extended benefits tax – An additional

any areas of inappropriate activity relating to

0.1% levied on all contributing employers

benefit payments.

Also, we conclude the

to pay for the State’s 50% share of

borrowing of $360 million from the federal

extended benefits when the unemploy-

government to pay unemployment benefits

ment insurance fund balance is insufficient

was allowed and necessary. At December

to pay those benefits deemed necessary

31, 2011, DWS had a remaining loan

by the federal government.

When

balance of $330.9 million, which is expected

deemed necessary, the federal govern-

ment provides funding for 50% of the

to be repaid with interest by 2015. The loan

extended benefits.

interest payments are funded by a 0.2%

The advance interest tax – An additional

increase in the unemployment tax rate paid

by all contributing employers. Additionally,

0.2% levied on all contributing employers

to pay the interest on the advances made

we conclude the $161.3 million in overpay-

by the U.S. Treasury to fund unemploy-

ments reported by the USDOL is only a

ment insurance benefits in excess of other

performance measure used to evaluate

sources of funding.

benefit processing procedures and is not an

amount expected to be repaid to the federal

government.

Source: Arkansas Department of Workforce Services

7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12