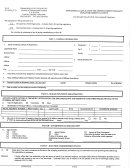

Form Esd-Ark-501 - Application For Unemployment Insurance Benefits Page 5

ADVERTISEMENT

Arkansas Division of Legislative Audit

USDOL

requires

all

states

to

review

statistics show 1,000 FIRE Unit investiga-

processed claims so that the USDOL can

tions, on average, are initiated each week.

calculate each state’s estimated amount of

When completed timely, the quarterly match

benefits

overpayment.

The

USDOL

process effectively identifies overpayments.

predetermines the claims to be selected for

However, the process cannot be completed

testing, and states are expected to review a

for up to five months for two reasons that are

minimum number of cases each week. The

beyond DWS’ control: First, employer quar-

USDOL expects Arkansas to review a

terly wage files can be received manually or

minimum of 10 paid claims and 9 denied

electronically, and second, time must be

claims each week, totaling 480 paid claims

allowed for interstate wages (i.e., Arkansas

and 450 denied claims per year.

wages employers report to another state) to

be processed and submitted to a national

The primary purpose of the testing is to

database.

identify system-wide errors and prevent

future errors. The BAM Unit then tracks the

BPC Unit

impact of corrective actions by monitoring

the results of subsequent testing.

BAM

The BPC Unit’s function is to record,

testing results are submitted to a USDOL

calculate, manage, collect, and report on all

database and reported on the USDOL’s

benefit overpayments identified by DWS.

website using varying rate measurements.

Overpayment reimbursements are received

from claimants, courts, and DFA state in-

FIRE Unit

come tax refund intercepts.

The FIRE Unit investigates claimants who

Federal Calculation of Overpayments

incorrectly reported earnings, and prosecu-

tion is pursued if the benefit overpayment

BAM Unit testing data are used to ensure the

amount is more than $12,000. FIRE collects

integrity of the systems states use to

evidence for Arkansas prosecuting attorneys

administer unemployment insurance benefits

who then determine if criminal charges will

and to verify those processes comply with

be filed.

federal requirements.

Using each state’s

BAM testing results, the USDOL then

The FIRE Unit uses specialized software to

calculates and reports the estimated over-

automate

processing

of

85%

of

its

payment amount on its website and to the

investigations. This automation is designed

federal Office of Management and Budget.

to identify claimants recently hired to new

jobs who continue to file weekly benefit

On September 16, 2011, the USDOL

claims through two cross matching proc-

released statistics on unemployment benefit

esses: a quarterly benefit/wage match and a

overpayments for all states based on BAM

weekly new hire data match. The benefit/

Unit testing data.

Arkansas was listed as

wage data, which identify those claiming

having an overpayment performance meas-

unemployment

benefits

while

drawing

ure of $161.3 million in unemployment

wages, are derived from federally mandated

benefits from July 1, 2008 through June 30,

quarterly employer payroll reports.

2011. The USDOL cited the primary over-

Each quarterly cross match compares DWS

payment cause in 63% of cases as claimants

weekly paid claims to the employer quarterly

continuing to claim and receive benefits after

wage file information for the same time

returning to work. The USDOL also reported

period.

This matching process generally

that DWS is fully or partially responsible for

takes one week to complete. Because FIRE

15% of the $161.3 million estimated overpay-

Unit resources are limited to six investiga-

ments, with the claimant or employer being

tors, the number of investigations opened is

fully or partially responsible for the remaining

based on staffing availability. Recent DWS

85%.

The USDOL ranked Arkansas as

5

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12