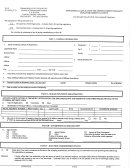

Form Esd-Ark-501 - Application For Unemployment Insurance Benefits Page 2

ADVERTISEMENT

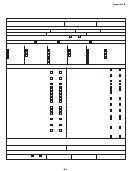

Arkansas Department of Workforce Services - Review of Unemployment Insurance

Exhibit I

Exhibit II

Arkansas Department of Workforce Services

Arkansas Department of Workforce Services

Local Offices

Unemployment Insurance Claims

As of December 31, 2011

Fiscal Years 2006 through 2011

.

.

.

Rogers

Mtn. Home

Number of Weekly Claims Filed

.

.

Harrison

.

.

Fayetteville

.

Paragould

Walnut Ridge

Blytheville

.

3,000,000

Jonesboro

.

Batesville

Newport

.

.

.

.

Russellville

W. Memphis

Ft. Smith

.

.

Searcy

Forest City

Conway

.

.

2,000,000

Jacksonville

.

. .

Little Rock

.

Helena/

Benton

Hot Springs

. .

Mena

W. Helena

.

Malvern

Pine Bluff

Arkadelphia

.

1,000,000

Hope

.

.

.

Monticello

Camden

Texarkana

.

.

Magnolia

El Dorado

0

Source: Arkansas Department of Workforce Services

2006 2007 2008 2009 2010 2011

to the recent national economic recession,

total claims for benefits have increased

$1,200,000,000

Amount of Benefits Paid

significantly over the last five years. Exhibit

II illustrates the number of claims filed and

$1,000,000,000

the amount of benefits paid during fiscal

years 2006 through 2011.

$800,000,000

Unemployment

insurance

benefits

are

funded by taxes collected from employers.

$600,000,000

DWS collects unemployment insurance from

two types of taxpayers:

reimbursing and

contributing.

Reimbursing taxpayers are

$400,000,000

governmental entities (i.e., federal, state, and

local), political subdivisions (i.e., K-12 school

$200,000,000

districts), and Internal Revenue Code 501(c)

(3) non-profit organizations. These taxpay-

$-

ers report wages paid to employees but,

instead of paying tax on the wages,

reimburse DWS for any benefits paid on their

behalf. These entities, in effect, self-insure

Source: Arkansas Department of Workforce Services

their risk for unemployment claims.

(unaudited by the Division of Legislative Audit)

All

remaining

entities

are

considered

contributing taxpayers. These taxpayers re-

employee in each calendar year.

If state

port wages paid quarterly and pay the

payments are made timely, employers pay a

Arkansas unemployment contribution rate on

lower federal unemployment tax rate. The

the first $12,000 (increased from $10,000 on

contribution rate varies by employer and is

January 1, 2010) of wages paid to each

detailed later in the report.

2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12