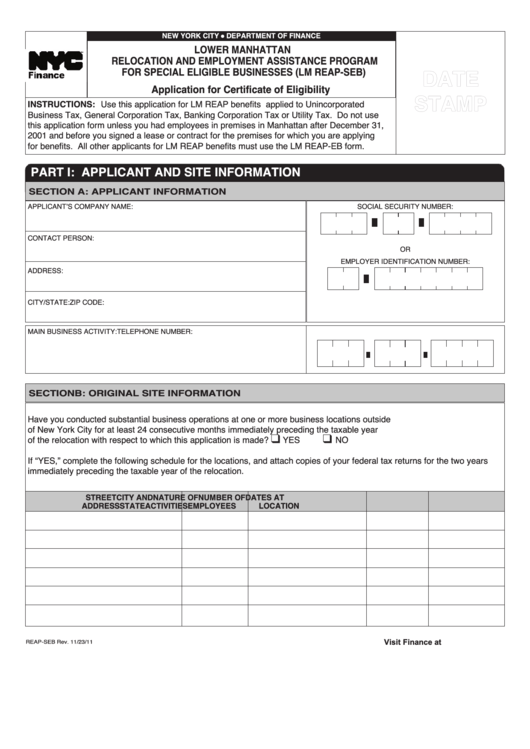

Form Reap-Seb - Lower Manhattan Relocation And Employment Assistance Program Benefits For Special Eligible Businesses

ADVERTISEMENT

NEW YORK CITY

DEPARTMENT OF FINANCE

LOWER MANHATTAN

l

DATE

RELOCATION AND EMPLOYMENT ASSISTANCE PROGRAM

FOR SPECIAL ELIGIBLE BUSINESSES (LM REAP-SEB)

STAMP

Application for Certificate of Eligibility

INSTRUCTIONS: Use this application for LM REAP benefits applied to Unincorporated

Business Tax, General Corporation Tax, Banking Corporation Tax or Utility Tax. Do not use

this application form unless you had employees in premises in Manhattan after December 31,

2001 and before you signed a lease or contract for the premises for which you are applying

for benefits. All other applicants for LM REAP benefits must use the LM REAP-EB form.

PART I: APPLICANT AND SITE INFORMATION

SECTION A: APPLICANT INFORMATION

APPLICANT’S COMPANY NAME:

SOCIAL SECURITY NUMBER:

CONTACT PERSON:

OR

EMPLOYER IDENTIFICATION NUMBER:

ADDRESS:

CITY/STATE:

ZIP CODE:

MAIN BUSINESS ACTIVITY:

TELEPHONE NUMBER:

SECTION B: ORIGINAL SITE INFORMATION

Have you conducted substantial business operations at one or more business locations outside

of New York City for at least 24 consecutive months immediately preceding the taxable year

q

q

of the relocation with respect to which this application is made? ............................................................

YES

NO

If “YES,” complete the following schedule for the locations, and attach copies of your federal tax returns for the two years

immediately preceding the taxable year of the relocation.

STREET

CITY AND

NATURE OF

NUMBER OF

DATES AT

ADDRESS

STATE

ACTIVITIES

EMPLOYEES

LOCATION

Visit Finance at nyc.gov/finance

REAP-SEB Rev. 11/23/11

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5