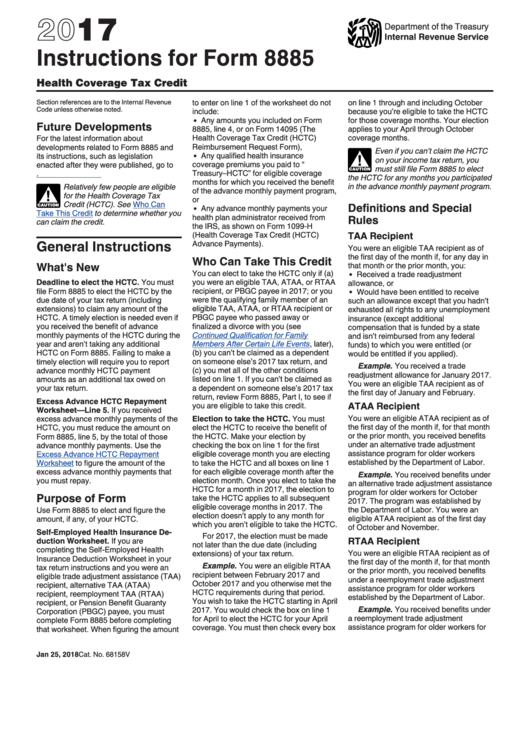

Instructions For Form 8885 - Health Coverage Tax Credit - 2017

ADVERTISEMENT

2017

Department of the Treasury

Internal Revenue Service

Instructions for Form 8885

Health Coverage Tax Credit

Section references are to the Internal Revenue

to enter on line 1 of the worksheet do not

on line 1 through and including October

Code unless otherwise noted.

include:

because you’re eligible to take the HCTC

Any amounts you included on Form

for those coverage months. Your election

Future Developments

8885, line 4, or on Form 14095 (The

applies to your April through October

Health Coverage Tax Credit (HCTC)

coverage months.

For the latest information about

Reimbursement Request Form),

developments related to Form 8885 and

Even if you can’t claim the HCTC

Any qualified health insurance

its instructions, such as legislation

on your income tax return, you

!

coverage premiums you paid to “U.S.

enacted after they were published, go to

must still file Form 8885 to elect

Treasury–HCTC” for eligible coverage

IRS.gov/Form8885.

CAUTION

the HCTC for any months you participated

months for which you received the benefit

in the advance monthly payment program.

Relatively few people are eligible

of the advance monthly payment program,

for the Health Coverage Tax

!

or

Credit (HCTC). See

Who Can

Definitions and Special

Any advance monthly payments your

CAUTION

Take This Credit

to determine whether you

health plan administrator received from

Rules

can claim the credit.

the IRS, as shown on Form 1099-H

TAA Recipient

(Health Coverage Tax Credit (HCTC)

General Instructions

Advance Payments).

You were an eligible TAA recipient as of

the first day of the month if, for any day in

Who Can Take This Credit

What's New

that month or the prior month, you:

You can elect to take the HCTC only if (a)

Received a trade readjustment

you were an eligible TAA, ATAA, or RTAA

Deadline to elect the HCTC. You must

allowance, or

recipient, or PBGC payee in 2017; or you

file Form 8885 to elect the HCTC by the

Would have been entitled to receive

due date of your tax return (including

were the qualifying family member of an

such an allowance except that you hadn’t

extensions) to claim any amount of the

eligible TAA, ATAA, or RTAA recipient or

exhausted all rights to any unemployment

HCTC. A timely election is needed even if

PBGC payee who passed away or

insurance (except additional

you received the benefit of advance

finalized a divorce with you (see

compensation that is funded by a state

Continued Qualification for Family

monthly payments of the HCTC during the

and isn’t reimbursed from any federal

Members After Certain Life

Events, later),

year and aren’t taking any additional

funds) to which you were entitled (or

(b) you can’t be claimed as a dependent

HCTC on Form 8885. Failing to make a

would be entitled if you applied).

timely election will require you to report

on someone else’s 2017 tax return, and

Example. You received a trade

advance monthly HCTC payment

(c) you met all of the other conditions

readjustment allowance for January 2017.

amounts as an additional tax owed on

listed on line 1. If you can’t be claimed as

You were an eligible TAA recipient as of

your tax return.

a dependent on someone else’s 2017 tax

the first day of January and February.

return, review Form 8885, Part I, to see if

Excess Advance HCTC Repayment

ATAA Recipient

you are eligible to take this credit.

Worksheet—Line 5. If you received

You were an eligible ATAA recipient as of

Election to take the HCTC. You must

excess advance monthly payments of the

the first day of the month if, for that month

elect the HCTC to receive the benefit of

HCTC, you must reduce the amount on

or the prior month, you received benefits

Form 8885, line 5, by the total of those

the HCTC. Make your election by

under an alternative trade adjustment

advance monthly payments. Use the

checking the box on line 1 for the first

assistance program for older workers

Excess Advance HCTC Repayment

eligible coverage month you are electing

established by the Department of Labor.

Worksheet

to figure the amount of the

to take the HCTC and all boxes on line 1

for each eligible coverage month after the

excess advance monthly payments that

Example. You received benefits under

election month. Once you elect to take the

you must repay.

an alternative trade adjustment assistance

HCTC for a month in 2017, the election to

program for older workers for October

Purpose of Form

take the HCTC applies to all subsequent

2017. The program was established by

eligible coverage months in 2017. The

the Department of Labor. You were an

Use Form 8885 to elect and figure the

election doesn’t apply to any month for

eligible ATAA recipient as of the first day

amount, if any, of your HCTC.

which you aren’t eligible to take the HCTC.

of October and November.

Self-Employed Health Insurance De-

For 2017, the election must be made

RTAA Recipient

duction Worksheet. If you are

not later than the due date (including

completing the Self-Employed Health

You were an eligible RTAA recipient as of

extensions) of your tax return.

Insurance Deduction Worksheet in your

the first day of the month if, for that month

Example. You were an eligible RTAA

tax return instructions and you were an

or the prior month, you received benefits

recipient between February 2017 and

eligible trade adjustment assistance (TAA)

under a reemployment trade adjustment

October 2017 and you otherwise met the

recipient, alternative TAA (ATAA)

assistance program for older workers

HCTC requirements during that period.

recipient, reemployment TAA (RTAA)

established by the Department of Labor.

You wish to take the HCTC starting in April

recipient, or Pension Benefit Guaranty

Example. You received benefits under

2017. You would check the box on line 1

Corporation (PBGC) payee, you must

a reemployment trade adjustment

for April to elect the HCTC for your April

complete Form 8885 before completing

assistance program for older workers for

coverage. You must then check every box

that worksheet. When figuring the amount

Jan 25, 2018

Cat. No. 68158V

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6