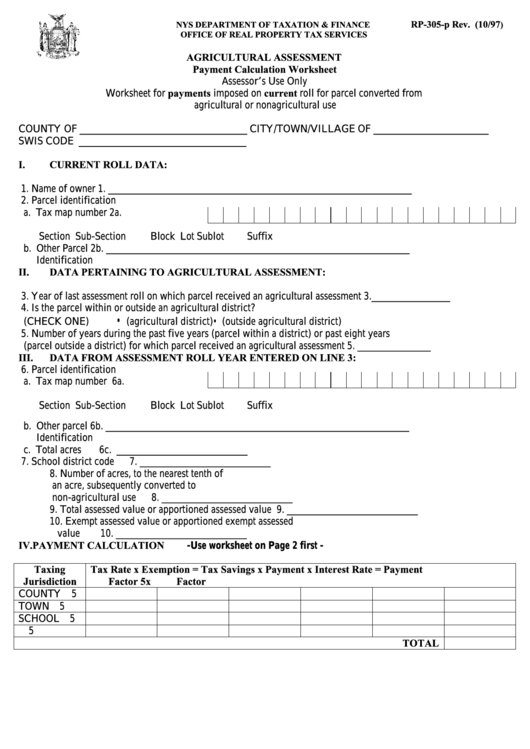

RP-305-p Rev. (10/97

NYS DEPARTMENT OF TAXATION & FINANCE

)

OFFICE OF REAL PROPERTY TAX SERVICES

AGRICULTURAL ASSESSMENT

Payment Calculation Worksheet

Assessor’s Use Only

Worksheet for payments imposed on current roll for parcel converted from

agricultural or nonagricultural use

COUNTY OF ________________________________

CITY/TOWN/VILLAGE OF ______________________

SWIS CODE ________________________________

I.

CURRENT ROLL DATA:

1.

Name of owner

1.

__________________________________________________________

2.

Parcel identification

a. Tax map number 2a.

Section

Sub-Section

Block

Lot

Sublot

Suffix

b. Other Parcel

2b.

__________________________________________________________

Identification

II.

DATA PERTAINING TO AGRICULTURAL ASSESSMENT:

3.

Year of last assessment roll on which parcel received an agricultural assessment 3._______________

4.

Is the parcel within or outside an agricultural district?

•

(CHECK ONE)

(agricultural district)

• (outside agricultural district)

5.

Number of years during the past five years (parcel within a district) or past eight years

(parcel outside a district) for which parcel received an agricultural assessment

5. ______________

III.

DATA FROM ASSESSMENT ROLL YEAR ENTERED ON LINE 3:

6.

Parcel identification

a. Tax map number 6a.

Section

Sub-Section

Block

Lot

Sublot

Suffix

b. Other parcel

6b.

__________________________________________________________

Identification

c. Total acres

6c.

_________________________

7.

School district code

7.

_________________________

8.

Number of acres, to the nearest tenth of

an acre, subsequently converted to

non-agricultural use

8.

_________________________

9.

Total assessed value or apportioned assessed value

9.

_________________________

10.

Exempt assessed value or apportioned exempt assessed

value

10.

_________________________

IV.

PAYMENT CALCULATION

-Use worksheet on Page 2 first -

Taxing

Tax Rate x Exemption = Tax Savings x Payment x Interest Rate = Payment

Jurisdiction

Factor 5x

Factor

COUNTY

5

TOWN

5

SCHOOL

5

5

TOTAL

1

1 2

2 3

3