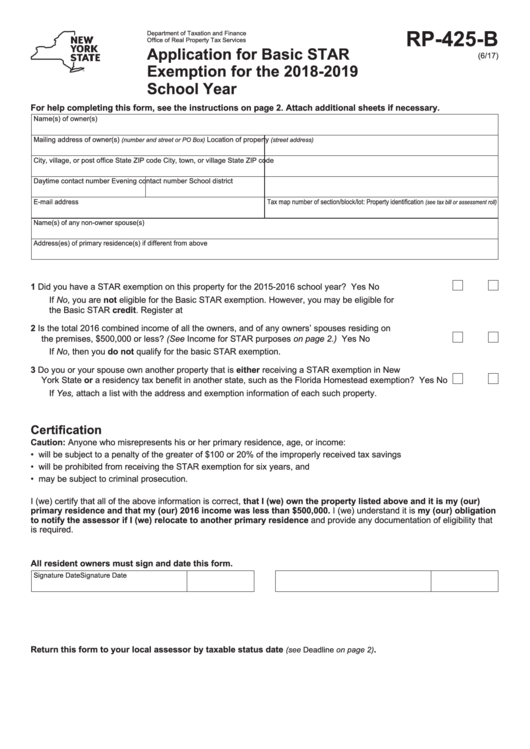

RP-425-B

Department of Taxation and Finance

Office of Real Property Tax Services

Application for Basic STAR

(6/17)

Exemption for the 2018-2019

School Year

For help completing this form, see the instructions on page 2. Attach additional sheets if necessary.

Name(s) of owner(s)

Mailing address of owner(s)

Location of property

(number and street or PO Box)

(street address)

City, village, or post office

State

ZIP code

City, town, or village

State

ZIP code

Daytime contact number

Evening contact number

School district

E-mail address

Tax map number of section/block/lot: Property identification

(see tax bill or assessment roll)

Name(s) of any non-owner spouse(s)

Address(es) of primary residence(s) if different from above

1 Did you have a STAR exemption on this property for the 2015-2016 school year? ................................. Yes

No

If No, you are not eligible for the Basic STAR exemption. However, you may be eligible for

the Basic STAR credit. Register at

2 Is the total 2016 combined income of all the owners, and of any owners’ spouses residing on

the premises, $500,000 or less? (See Income for STAR purposes on page 2.) ...................................... Yes

No

If No, then you do not qualify for the basic STAR exemption.

3 Do you or your spouse own another property that is either receiving a STAR exemption in New

York State or a residency tax benefit in another state, such as the Florida Homestead exemption? ...... Yes

No

If Yes, attach a list with the address and exemption information of each such property.

Certification

Caution: Anyone who misrepresents his or her primary residence, age, or income:

• will be subject to a penalty of the greater of $100 or 20% of the improperly received tax savings

• will be prohibited from receiving the STAR exemption for six years, and

• may be subject to criminal prosecution.

I (we) certify that all of the above information is correct, that I (we) own the property listed above and it is my (our)

primary residence and that my (our) 2016 income was less than $500,000. I (we) understand it is my (our) obligation

to notify the assessor if I (we) relocate to another primary residence and provide any documentation of eligibility that

is required.

All resident owners must sign and date this form.

Signature

Date

Signature

Date

Return this form to your local assessor by taxable status date

.

(see Deadline on page 2)

1

1 2

2