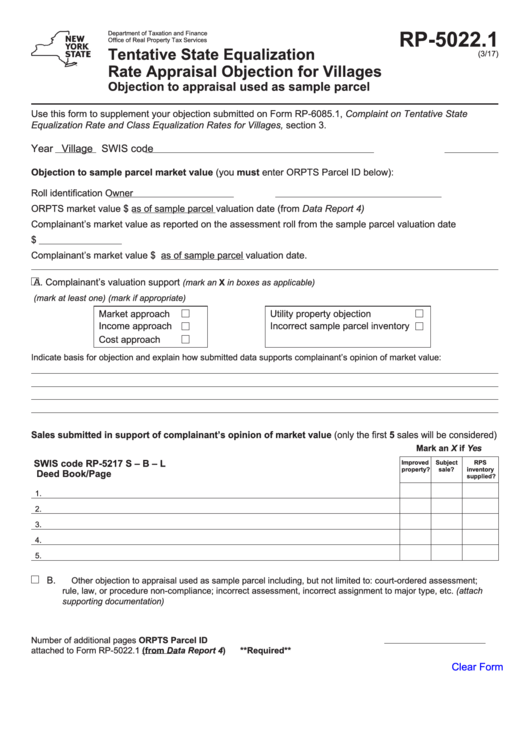

RP-5022.1

Department of Taxation and Finance

Office of Real Property Tax Services

Tentative State Equalization

(3/17)

Rate Appraisal Objection for Villages

Objection to appraisal used as sample parcel

Use this form to supplement your objection submitted on Form RP-6085.1, Complaint on Tentative State

Equalization Rate and Class Equalization Rates for Villages, section 3.

Year

Village

SWIS code

Objection to sample parcel market value (you must enter ORPTS Parcel ID below):

Roll identification

Owner

ORPTS market value $

as of sample parcel valuation date (from Data Report 4)

Complainant’s market value as reported on the assessment roll from the sample parcel valuation date

$

Complainant’s market value $

as of sample parcel valuation date.

A. Complainant’s valuation support

(mark an X in boxes as applicable)

(mark at least one)

(mark if appropriate)

Market approach

Utility property objection

Income approach

Incorrect sample parcel inventory

Cost approach

Indicate basis for objection and explain how submitted data supports complainant’s opinion of market value:

Sales submitted in support of complainant’s opinion of market value (only the first 5 sales will be considered)

Mark an X if Yes

SWIS code

RP-5217

S – B – L

Improved

Subject

RPS

property?

sale?

inventory

Deed Book/Page

supplied?

1.

2.

3.

4.

5.

B.

Other objection to appraisal used as sample parcel including, but not limited to: court-ordered assessment;

rule, law, or procedure non-compliance; incorrect assessment, incorrect assignment to major type, etc. (attach

supporting documentation)

Number of additional pages

ORPTS Parcel ID

attached to Form RP-5022.1

(from Data Report 4)

**Required**

Clear Form

1

1