Form Dr-17a - Florida Sales And Use Tax Certificate Of Cash Deposit Or Cash Bond

ADVERTISEMENT

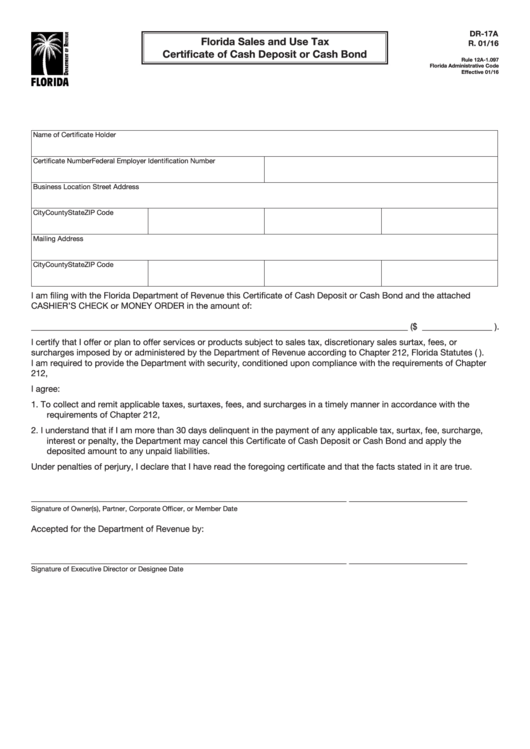

DR-17A

Florida Sales and Use Tax

R. 01/16

Certificate of Cash Deposit or Cash Bond

Rule 12A-1.097

Florida Administrative Code

Effective 01/16

Name of Certificate Holder

Certificate Number

Federal Employer Identification Number

Business Location Street Address

City

County

State

ZIP Code

Mailing Address

City

County

State

ZIP Code

I am filing with the Florida Department of Revenue this Certificate of Cash Deposit or Cash Bond and the attached

CASHIER’S CHECK or MONEY ORDER in the amount of:

______________________________________________________________________________________ ($ ________________ ).

I certify that I offer or plan to offer services or products subject to sales tax, discretionary sales surtax, fees, or

surcharges imposed by or administered by the Department of Revenue according to Chapter 212, Florida Statutes (F.S.).

I am required to provide the Department with security, conditioned upon compliance with the requirements of Chapter

212, F.S.

I agree:

1. To collect and remit applicable taxes, surtaxes, fees, and surcharges in a timely manner in accordance with the

requirements of Chapter 212, F.S.

2. I understand that if I am more than 30 days delinquent in the payment of any applicable tax, surtax, fee, surcharge,

interest or penalty, the Department may cancel this Certificate of Cash Deposit or Cash Bond and apply the

deposited amount to any unpaid liabilities.

Under penalties of perjury, I declare that I have read the foregoing certificate and that the facts stated in it are true.

________________________________________________________________________

___________________________

Signature of Owner(s), Partner, Corporate Officer, or Member

Date

Accepted for the Department of Revenue by:

________________________________________________________________________

___________________________

Signature of Executive Director or Designee

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1