Form F-1196 Draft - Allocation For Research And Development Tax Credit For Florida Corporate Income/franchise Tax Page 5

ADVERTISEMENT

the business enterprise, or a predecessor corporation that was a business enterprise, did not

exist.

Taxable years preceding the taxable year of the

Qualified research expenses in Florida

credit

(Enter whole dollar amount only.)

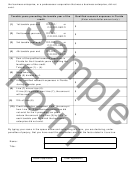

//

(1)

1st taxable year end

or

$

//20

//

(2)

2nd taxable year end

or

$

//20

//

(3)

3rd taxable year end

or

$

//20

//

(4)

4th taxable year end

or

$

//20

(5)

Sum of the qualified research expenses in

Florida for the 4 taxable years preceding the

$

taxable year of the credit.

Total of Lines (1) – (4).

(6)

Base amount.

$

Line (5) divided by 4.

(7)

Enter qualified research expenses in Florida

$

during calendar year

.

(8)

Line (7) minus Line (6).

If Line (6) is greater than Line (7), the amount

$

will be zero.

(9)

10% of Line (8).

$

(10) Credit allocation requested. Enter the amount

from Line (9). If the business enterprise did

not exist for the 4 preceding tax years,

$

reduce the amount from Line (9) by 25% for

each taxable year for which the business

enterprise did not exist.

By typing your name in the space below and submitting this form, you are declaring, under

penalties of perjury, that you have read this application and that the facts stated in it are true.

Name:

Title:

Submit Application

Clear Application

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5