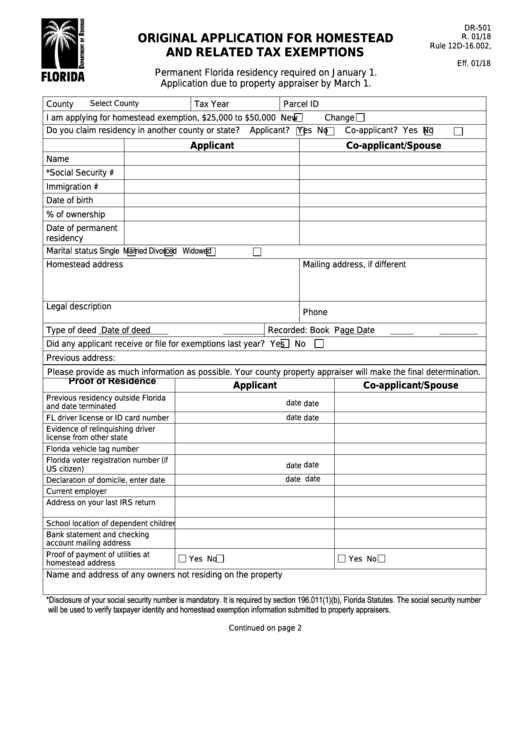

DR-501

ORIGINAL APPLICATION FOR HOMESTEAD

R. 01/18

Rule 12D-16.002,

AND RELATED TAX EXEMPTIONS

F.A.C

Eff. 01/18

Permanent Florida residency required on January 1.

Application due to property appraiser by March 1.

County

Select County

Tax Year

Parcel ID

I am applying for homestead exemption, $25,000 to $50,000

New

Change

Do you claim residency in another county or state?

Applicant?

Yes

No

Co-applicant?

Yes

No

Applicant

Co-applicant/Spouse

Name

*Social Security #

Immigration #

Date of birth

% of ownership

Date of permanent

residency

Single

Married

Divorced

Widowed

Marital status

Homestead address

Mailing address, if different

Legal description

Phone

Type of deed

Date of deed

Recorded:

Book

Page

Date

Did any applicant receive or file for exemptions last year?

Yes

No

Previous address:

Please provide as much information as possible. Your county property appraiser will make the final determination.

Proof of Residence

Applicant

Co-applicant/Spouse

Previous residency outside Florida

date

date

and date terminated

date

FL driver license or ID card number

date

Evidence of relinquishing driver

license from other state

Florida vehicle tag number

Florida voter registration number (if

date

date

US citizen)

date

date

Declaration of domicile, enter date

Current employer

Address on your last IRS return

School location of dependent children

Bank statement and checking

account mailing address

Proof of payment of utilities at

Yes

No

Yes

No

homestead address

Name and address of any owners not residing on the property

*Disclosure of your social security number is mandatory. It is required by section 196.011(1)(b), Florida Statutes. The social security number

will be used to verify taxpayer identity and homestead exemption information submitted to property appraisers.

Continued on page 2

1

1 2

2 3

3