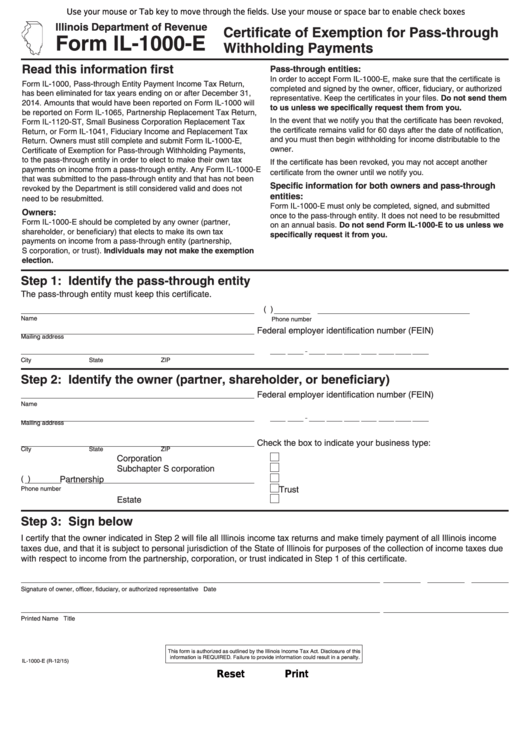

Use your mouse or Tab key to move through the fields. Use your mouse or space bar to enable check boxes.

Illinois Department of Revenue

Certificate of Exemption for Pass-through

Form IL-1000-E

Withholding Payments

Read this information first

Pass-through entities:

In order to accept Form IL-1000-E, make sure that the certificate is

Form IL-1000, Pass-through Entity Payment Income Tax Return,

completed and signed by the owner, officer, fiduciary, or authorized

has been eliminated for tax years ending on or after December 31,

representative. Keep the certificates in your files. Do not send them

2014. Amounts that would have been reported on Form IL-1000 will

to us unless we specifically request them from you.

be reported on Form IL-1065, Partnership Replacement Tax Return,

In the event that we notify you that the certificate has been revoked,

Form IL-1120-ST, Small Business Corporation Replacement Tax

the certificate remains valid for 60 days after the date of notification,

Return, or Form IL-1041, Fiduciary Income and Replacement Tax

and you must then begin withholding for income distributable to the

Return. Owners must still complete and submit Form IL-1000-E,

owner.

Certificate of Exemption for Pass-through Withholding Payments,

to the pass-through entity in order to elect to make their own tax

If the certificate has been revoked, you may not accept another

payments on income from a pass-through entity. Any Form IL-1000-E

certificate from the owner until we notify you.

that was submitted to the pass-through entity and that has not been

Specific information for both owners and pass-through

revoked by the Department is still considered valid and does not

entities:

need to be resubmitted.

Form IL-1000-E must only be completed, signed, and submitted

Owners:

once to the pass-through entity. It does not need to be resubmitted

Form IL-1000-E should be completed by any owner (partner,

on an annual basis. Do not send Form IL-1000-E to us unless we

shareholder, or beneficiary) that elects to make its own tax

specifically request it from you.

payments on income from a pass-through entity (partnership,

S corporation, or trust). Individuals may not make the exemption

election.

Step 1: Identify the pass-through entity

The pass-through entity must keep this certificate.

(

)

Name

Phone number

Federal employer identification number (FEIN)

Mailing address

City

State

ZIP

Step 2: Identify the owner (partner, shareholder, or beneficiary)

Federal employer identification number (FEIN)

Name

Mailing address

Check the box to indicate your business type:

City

State

ZIP

Corporation

Subchapter S corporation

(

)

Partnership

Trust

Phone number

Estate

Step 3: Sign below

I certify that the owner indicated in Step 2 will file all Illinois income tax returns and make timely payment of all Illinois income

taxes due, and that it is subject to personal jurisdiction of the State of Illinois for purposes of the collection of income taxes due

with respect to income from the partnership, corporation, or trust indicated in Step 1 of this certificate.

Signature of owner, officer, fiduciary, or authorized representative

Date

Printed Name

Title

This form is authorized as outlined by the Illinois Income Tax Act. Disclosure of this

information is REQUIRED. Failure to provide information could result in a penalty.

IL-1000-E (R-12/15)

Reset

Print

1

1