Form Qr 29 - Applicant Test

Download a blank fillable Form Qr 29 - Applicant Test in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Qr 29 - Applicant Test with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

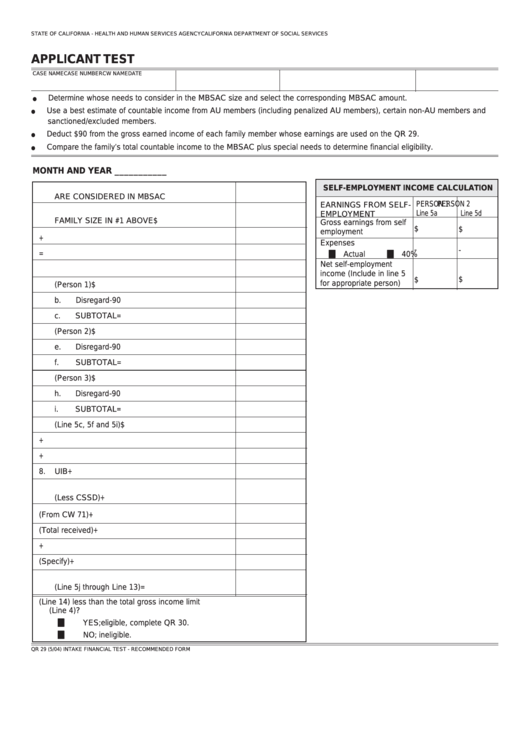

STATE OF CALIFORNIA - HEALTH AND HUMAN SERVICES AGENCY

CALIFORNIA DEPARTMENT OF SOCIAL SERVICES

APPLICANT TEST

CASE NAME

CASE NUMBER

CW NAME

DATE

Determine whose needs to consider in the MBSAC size and select the corresponding MBSAC amount.

Use a best estimate of countable income from AU members (including penalized AU members), certain non-AU members and

sanctioned/excluded members.

Deduct $90 from the gross earned income of each family member whose earnings are used on the QR 29.

Compare the family’s total countable income to the MBSAC plus special needs to determine financial eligibility.

MONTH AND YEAR ___________

1.

NUMBER OF FAMILY MEMBERS WHOSE NEEDS

SELF-EMPLOYMENT INCOME CALCULATION

ARE CONSIDERED IN MBSAC

PERSON 1

PERSON 2

EARNINGS FROM SELF-

2.

CORRESPONDING MBSAC FOR

Line 5a

Line 5d

EMPLOYMENT

FAMILY SIZE IN #1 ABOVE

$

Gross earnings from self

$

$

employment

3.

RECURRING SPECIAL NEEDS

+

Expenses

-

-

4.

TOTAL GROSS INCOME LIMIT

=

Actual

40%

Net self-employment

5.

GROSS EARNINGS COMPUTATION

income (Include in line 5

$

$

for appropriate person)

a.

Gross Earnings (Person 1)

$

b.

Disregard

-

90

c.

SUBTOTAL

=

d.

Gross Earnings (Person 2)

$

e.

Disregard

-

90

f.

SUBTOTAL

=

g.

Gross Earnings (Person 3)

$

h.

Disregard

-

90

i.

SUBTOTAL

=

j.

TOTAL (Line 5c, 5f and 5i)

$

6.

SOCIAL SECURITY BENEFITS

+

7.

V.A. BENEFITS

+

8.

UIB

+

9.

CHILD/SPOUSAL SUPPORT RECEIVED

(Less CSSD)

+

10. UA CONTRIBUTION (From CW 71)

+

11. UNEARNED IN-KIND (Total received)

+

12. ALL DISABILITY INCOME

+

13. OTHER (Specify)

+

14. TOTAL COUNTABLE INCOME

(Line 5j through Line 13)

=

15. Is total countable income (Line 14) less than the total gross income limit

(Line 4)?

YES; eligible, complete QR 30.

NO; ineligible.

QR 29 (5/04) INTAKE FINANCIAL TEST - RECOMMENDED FORM

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1